BTC THE STANDARD

A dream 13 years deferred

Bitcoin has completed a mini full circle. When the elusive Satoshi Nakamoto penned their historical whitepaper in October 2008, a seed was planted that has borne strange, beautiful, and unexpected fruit over the past decade. Toying with a sapling of an idea, Nakamoto wrote in his fateful mailer:

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted party”.

Twelve years later, that vision is being realized by at least one sovereign. El Salvador ushered in a new era by codifying the cryptocurrency as legal tender in the small Central American nation.

El Salvador’s decision to adopt Bitcoin comes during an especially volatile period for the token. Retracing sharply from $64k highs to the $30k region in just a month, BTC has been plagued by a maelstrom of FUD, particularly surrounding its energy usage. Despite the fact that Bitcoin mining incentivizes clean energy use, Elon Musk’s energy concerns made global headlines, tarnishing the network’s reputation with very little substantial input.

The Salvadorian vision

Enter Salvadorian president Nayib Bukele, who has countered the FUD orchestrated by the world’s richest individual by not only adopting Bitcoin, but also implementing BTC mining using renewable geothermal energy extracted from a volcano. To fully appreciate the boldness of Bukele’s decision, it’s worth considering that his country’s GDP stood at $27bn in 2019, roughly a tenth of Musk’s personal wealth.

Bukele’s updated Twitter avatar sports laser eyes in support of BTC

That an ailing, oft-ignored country plagued by debt, civil war, and US interventions could right the narrative conceived by a man of such exorbitant influence speaks to the core of Bitcoin’s ethos — an unflinching vision of a decentralised financial system that serves to empower the most marginalised among us, to bank the unbanked. In El Salvador specifically, roughly 70% of citizens do not have access to bank accounts. Globally, approximately 2 billion adults remain unbanked.

Nakamoto’s lofty ideals may have been contorted by speculative interest and early ties to illicit transactions, but El Salvador’s vote of confidence serves to reignite the dialogue around decentralised currencies as legal tender, particularly in nations still reliant on the US Dollar as a means of exchange.

Adapting BTC for legal tender

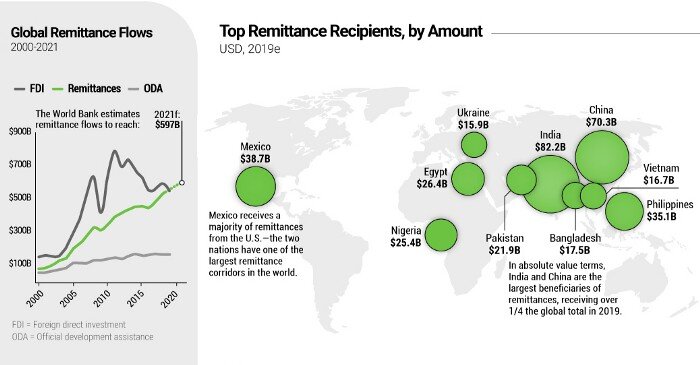

As the crypto space has grown, BTC’s primary role has transitioned from facilitating day-to-day transactions to acting as a hard Store of Value, akin to gold, largely due to slow block processing times and high transaction fees. In a country like El Salvador, where around 20% of GDP is sourced through remittances from Salvadorians working abroad, transaction fees in excess of $20 become highly prohibitive.

In order to make BTC viable for microtransactions at scale, Bukele’s cabinet has chosen to integrate the Lightning Network, a Layer 2 solution that allows for transacting BTC cheaply and efficiently without requiring each transaction to be broadcast to the blockchain. Using Lightning, parties may conduct BTC payments using channels, which are only registered on-chain when they are opened and closed. While a channel is open, parties may transact freely without routing through the main network.

BlockGeeks

Global impact

The successful implementation of a BTC standard in El Salvador could have major ramifications beyond the confines of its borders. Allowing remittances via BTC could save Salvadorians more than $100m in fees currently charged by intermediaries, while also enabling immediate access to funds, without having to spend hours fighting congested queues to receive cash. Further, Bukele is optimistic that his country’s Bitcoin friendly policies will attract global interest, speculating on June 6 that their decision to adopt could usher in a new wave of foreign investment into El Salvador.

As is characteristic of the cryptosphere’s short attention span, speculators have followed El Salvador’s announcement with excitement, debating which may be the next sovereign State to adopt BTC as legal tender.

Likely candidates have emerged in the form of other remittance-reliant economies, with Paraguay leading the charge to continue the disruptive change that looks set to spread across Latin America. However, like any worthy contender to disrupt the dominant financial system, moves such as this will inadvertently be met with significant challenges, especially from banks, who historically tend to respond poorly to attempts to deviate from reliance on the US Dollar as a standard for exchange.

Visual Capitalist

Indeed, the International Monetary Fund (IMF) was quick to voice concerns in the wake of El Salvador’s landmark announcement, suggesting that bitcoin tender brings with it “a number of macroeconomic, financial and legal issues that require very careful analysis”. Salvadorian officials have since been engaged in meetings with the IMF surrounding the policy’s implementation and the grant of a $1bn relief program.

And so, the David-and-Goliath narrative of Bitcoin’s rich, absurd canon gains another chapter. As we transition to a digitized, blockchain-integrated society, conversations surrounding value and ever-inflating fiat are set to capture the public’s imagination. As established central banks hone in on blockchain-based Central Bank Digital Currency (CBDC) solutions, and dollar-backed nations grow increasingly wary of inflationary policies enacted by the US Federal Reserve, a quiet struggle for equal access to opportunities and financial services rages on. Should El Salvador stand firm in its aims of banking its unbanked citizens, even in the face of increased incentives dangled by the G7 cohort, it may only be a matter of a time before we see Nakamoto’s dizzying dreams writ large.