Revenant II: Revenge of the Bear

Bears are patient creatures. Grizzlies can hibernate for up to seven months before awakening to grab hold of a prospective Oscar nominee. After 6 months of consecutive green candles across the board, the bears have wrestled control of the market away from unsuspecting bulls in a sudden 50% retrace for bitcoin from April’s $64k highs to a low of $27,5k on Wednesday.

Tradingview.com

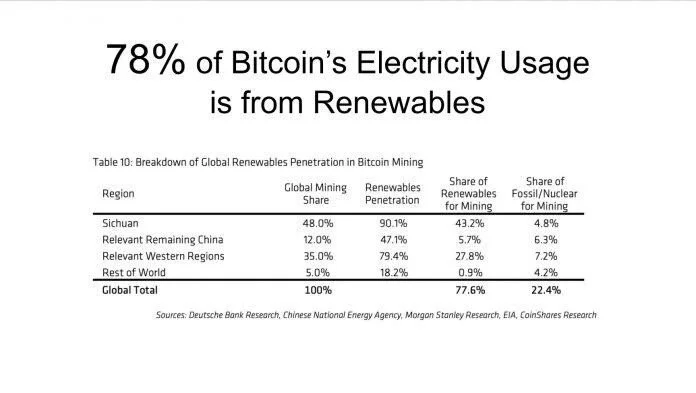

In a crazy market, one must find their John Fitzgerald. Look no further than instigator-extraordinaire Elon Musk, who contributed more than his fair share of FUD by making bold claims about excessive energy consumption by crypto miners. To be clear, the bitcoin network does use a lot of energy, but I challenge you to find a clearer opportunity to make use of otherwise wasted energy, especially from renewable sources. Even today, much of the mining that occurs in China is facilitated through hydroelectric power and not coal.

University of Cambridge (2020)

Demystifying the dump

For the traders in the room, one should always look to liquidations as an indicator for why the market might have moved drastically. As the perfect storm brewed and crypto assets dipped to a point where margin engines whirred to life and stop orders started to trigger en masse, we saw a cascade of liquidations on Wednesday. It’s quite something to note that over $8bn in longs were liquidated on centralised exchanges. This would absolutely have contributed to the price going down.

In the midst of the chaos, retail investors were left frustrated as several exchanges halted trading in response to extreme volatility. Binance paused all futures trading during the dip, while WazirX, India’s largest crypto exchange, went offline for several hours, forcing users to watch on helplessly as double-digit fluctuations printed by the minute. In contrast, DEFI lending and trading protocols stood up nicely at high volume. It’s a point of pride to note that during the most heavily volatile trading day in recent memory, VALR remained online and fully active throughout the dip.

It appeared that with everyone exhausted after such a busy week, appetite for weekend leveraged trading was low. The week wound to an end with relatively low exchange trade volume and significantly lower liquidation activity. Crypto prices continued to bleed over the weekend, but on very thin trading volume.

Dominance

BTC dominance has been waning in recent months and the story of May is coded largely in ERC-20. Ethereum has taken a large share of crypto dominance from Bitcoin, claiming a massive 20% of the total crypto market cap as ETH rocketed past $4400. Despite a shock retracement following this week’s crash, fresh whispers of The Flippening have been circulating in not-so-hushed tones. While the idea of ETH toppling BTC as the market’s dominant asset is still a controversial notion at best, recent metrics may well leave even the hardest bitcoin maximalists wringing sweaty palms. Significantly, ETH futures volume briefly surpassed BTC for the first time ever on 4 May as the Web 3.0 pioneer marched to a $400bn market cap, already roughly half of BTC’s near-Trillion dollar valuation.

Tradingview.com

Forward focus

Given that the last week has bordered on apocalyptic for many, it may help to consider that Bitcoin remains in excess of 350% higher than it was in May 2020. While the immediate chaos of sudden dips inadvertently drives one to obsess over 5 minute candles, longer-term charts paint a far healthier picture, perhaps even suggesting that a >30% correction might prove a much-needed catalyst for further growth on an asset only a decade old. On a timescale of years, retracements such as the one we find ourselves wading through are reduced to blips — stepping stones on an exponential journey toward global mass adoption.

Bears sustain themselves off long positions and short attention spans, scooping up holdings with masterful onslaughts of diversion. It remains to be seen whether determined bulls can prevent them from amassing stores before they once again retreat for winter.

Beeple: 20 May 2021