Crouching Grayscale, Hidden Hashing

Once again we find ourselves in the midst of midrange, as Bitcoin fought its way back from late June’s $28k lows. As traders scramble to realign their favourite drawings, macro factors have come to the fore in recent weeks.

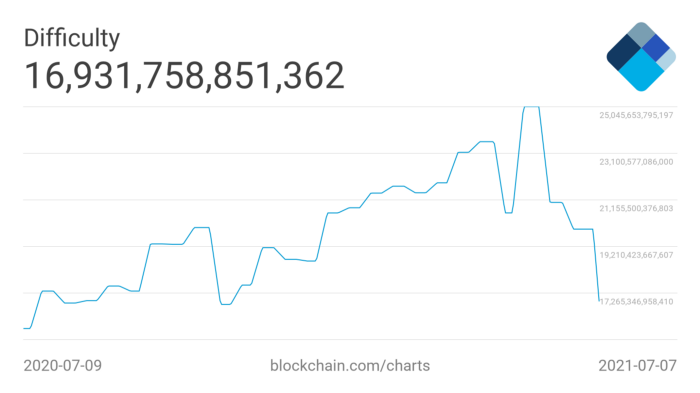

Front and centre is the mass exodus of BTC mining from China, following the well-publicized clampdown on cryptocurrency mining in the country. Hashrate — the global computing power of the network — observed its largest ever drop in the network’s history as Chinese miners went offline, falling in excess of 50% since its peak in mid-May.

Understanding blockchain mining

Less computing power means blocks take longer to solve, as mining difficulty increases. When Satoshi Nakamoto designed the network, they introduced a protocol to account for fluctuations in hash power. Nakamoto and co-developers strived for an average block confirmation time of 10 minutes. As a result, the network automatically recalibrates mining difficulty once every 2016 blocks (roughly two weeks) to align with the goal of 10-minute confirmation time.

In the wake of China’s final crypto reckoning, transaction times slowed to around 19 minutes as the — now much smaller — pool of existing miners attempt to generate the network’s next block. However, last Saturday, 2016 blocks later, mining difficulty fell by an unprecedented 28%, as the network’s algorithm readjusted to cater to a 10-minute transaction time.

The drop in hashrate may make BTC less resilient to attacks, but lowered mining difficulty is a boon for the network’s remaining miners, who are enjoying increased rewards as a result.

It remains to be seen which entities will fill the void left by China’s shutdowns, though its likely that the bulk of lost hash power may be absorbed by the US and Russia, the next-largest homes of active mining rigs.

As miners reap increased profits, the rest of the industry remains gripped by the pervading uncertainty that has nipped at the market’s ankles since May’s crash.

Institutional activity

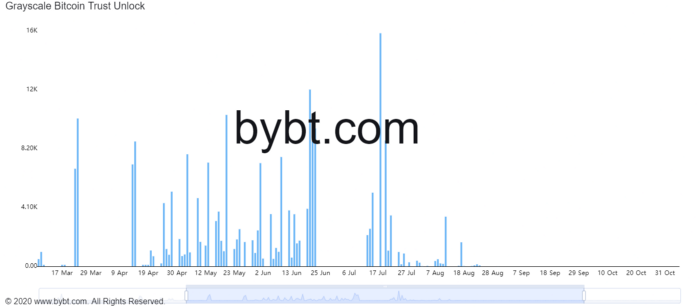

Institutional investment firm Grayscale have been amassing holdings to the tune of ~650,000 BTC in their GBTC Trust over the past year, offering investors an opportunity to buy GBTC shares pegged to BTC’s underlying value, subject to a six month lockup. Given that many investors poured funds into the Trust during the frenzy of January’s rolling gains, a significant portion of GBTC shares will be released over this month. On 17 July, ~16,400 GBTC shares are slated to be unlocked, ready to be claimed by investors. As this constitutes Grayscale’s largest token unlock to date, many analysts fear that the upcoming release of tokens to the market could once again push BTC below the tenuous $30k mark. JP Morgan’s analysis has warned of increased downward pressure as a result of the unlock, though the word of larger players should be taken with a pinch of salt.

As some have pointed out, these fears may be unfounded. As the world’s largest digital-asset trust, investors in GBTC are chiefly comprised of large institutional entities — many of whom likely invested with long-term BTC growth in mind. That being said, even large institutions may be unwilling to weather the prospect of further retracement for crypto, and could sell their GBTC in an effort to mitigate risk.

Regardless of the outcome, one thing is certain — with the market tuned to hair-trigger sensitivity, oscillating between the mid-to-low $30k’s as a gulf to $20k looms below, the stage is set for an explosive month, even by crypto’s usual standards.