HODLing is a virtue

Views expressed in the article below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

After briefly soaring to $67k, BTC has once again found itself in a tug-of-war as it fights to hold $60k. The rapid drawdown to $58k following the breach of new ATHs may be puzzling at first glance. However, a deeper investigation reveals a simple truth – the rampant euphoria of recent weeks has translated into extreme greed, with investors taking on high-risk leveraged positions across the futures markets.

Understanding leverage data

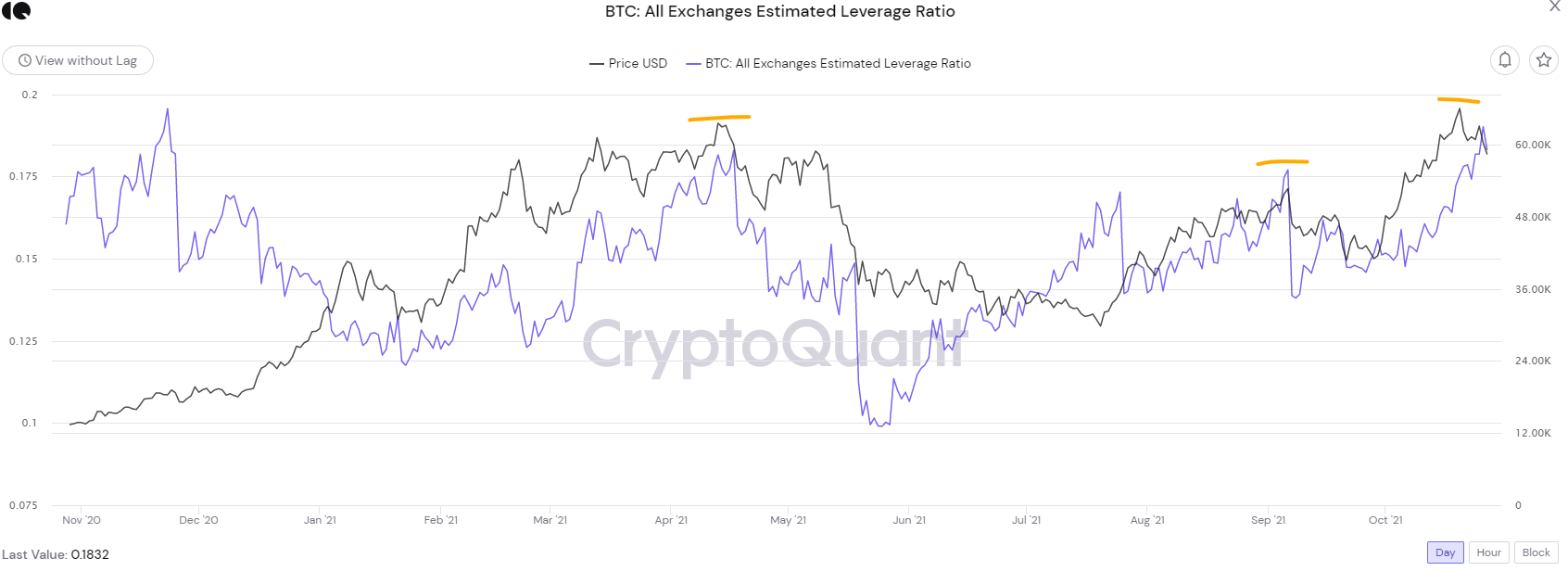

CryptoQuant offers in-depth insights into several key market metrics. In the chart below, the price of BTC is charted alongside an estimated leverage ratio. The leverage ratio presented is calculated by open interest across exchanges divided by the amount of BTC held on reserves.

Put simply, this indicator estimates the amount of leverage being used by average investors. With BTC rising alongside increased risk appetite, the estimated leverage ratio has risen. While this is typically a sign of optimistic market sentiment, an excessively high ratio indicates dangerous levels of exposure ripe for cascading liquidations.

CryptoQuant.com

And ripe they have been. Re-evaluating Bybt data, Tuesday saw more than $800m in liquidated longs across exchanges – with $500m being wiped out in just an hour as BTC fell 3% from $63k. This constitutes the largest liquidation event since September’s flash crash from $48k to $43k.

On the topic of mind-boggling figures, it’s worth observing a moment of silence for the entity whose Ethereum long on Bitfinex was liquidated with a position size of 35k ETH, which translates to roughly $140m at current prices.

What can we learn?

To quote the timeless wisdom of Winnie-the-Pooh: “Rivers know this: there is no hurry. We shall get there some day.”

In a nascent market that moves so fast it threatens to break the sound barrier on any given day, exposing oneself to amplified risk is largely unnecessary. While it’s easy to become desensitised in a space that sees sums exceeding 9 figures being thrown around with abandon, it’s vital to hold steadfast to personal goals and strategies, armed with the knowledge that regardless of short-term volatility, global adoption continues to increase in exponential waves. If there’s any market that can yield life-changing gains in the space of weeks and months by trading spot alone, it’s certainly crypto.

While trading futures can, undoubtedly, be a highly lucrative pursuit, it’s important to do ample research before considering entering derivatives. Strong conviction in BTC’s path to mass adoption is a common goal of all crypto enthusiasts. However, that same conviction can often spur impulsive decision making, as the “uponly” narrative can create a sense of perceived invincibility. The temptation to further increase gains through exposure to increased leverage is only natural, but also opens up the risk of liquidation as heightened volatility on the road to $100k will likely see flash crashes that far exceed the ~4% drop observed on Tuesday.

At the risk of paraphrasing a tradfi maximalist, it was Warren Buffett who once said that the stock market is a means of transferring wealth from the impatient to the patient. And while the technology in this industry is disrupting value, culture, and economics in a very real way, those same tenets espoused in decades past remain largely applicable to a speculative crypto market barely approaching adolescence.

When in doubt, zoom out