Old problems, novel solutions

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Despite escalating global tensions, crypto mounted a scintillating rally this week, with BTC rising almost 15% from $37k lows to the mid-$40k region within days of March’s open. Major indices have observed a similar trajectory, with the NASDAQ and S&P 500 also recovering following the significant retracements that came on the back of Russia announcing a full-scale invasion of Ukraine. As we discussed last week, this phenomenon is not unique to the conflict at hand, but has been observed in the wake of many previous major conflicts. However, this is the first time crypto has faced a global war-time macro landscape.

NASDAQ, SPX, and Bitcoin remain tightly correlated

Crowdfunding via crypto

Since the inception of BTC, crypto has espoused an ethos of borderless financial access without the need for intermediaries. The renewed popularity of Decentralised Autonomous Organisations (DAO) has seen ample projects launched with the aim of raising funds for specific goals. Notably, a DAO almost succeeded in purchasing one of the 13 remaining copies of the US Constitution back in November.

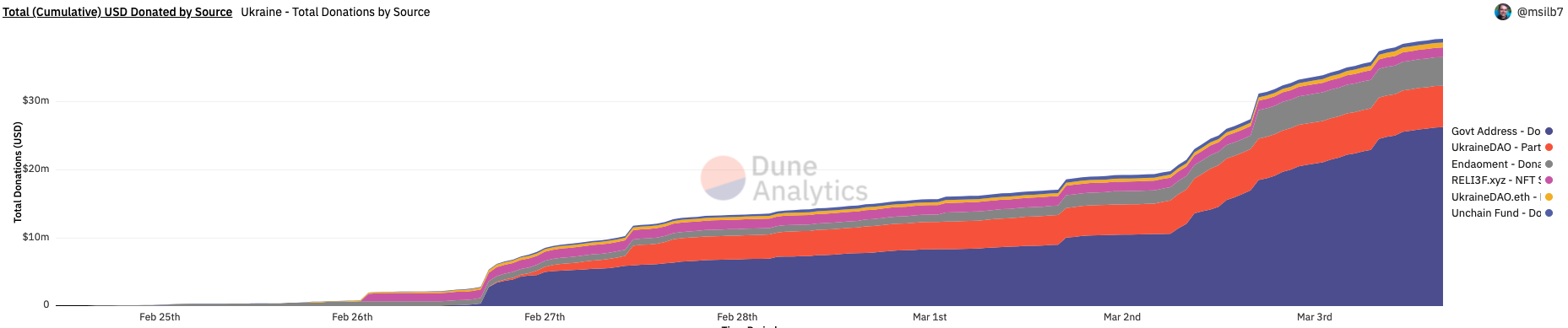

Never has this use case been more pertinent than at present, with the Ukrainian government opting to collect donations via crypto in an effort to provide aid to the conflict-ravaged region and its vulnerable populus. Since launching the initiative last Saturday, Ukraine has collected almost $50m in funding via a number of cryptocurrencies, including a CryptoPunk valued at $200k.

Crypto donations by source (USD)

Why crypto?

Crypto’s decentralised, largely frictionless infrastructure allows for rapid sourcing of funds from the global community, without being delayed by swathes of bureaucratic red tape. Given that the implementation of martial law in Ukraine has severely limited access to, and transfer of, funds entering the country, crypto provides a speedy alternative to the channels offered by traditional finance, without the potential of funds being locked in defaulting banks.

Concerns of the old guard

While Ukraine has been using crypto as a means to source funds to stave off Russian invasion, Russia has been considering the technology as a means to subvert increasingly aggressive economic sanctions imposed on the volatile nation. Faced with a collapsing economy and a spiraling ruble, the State has turned to its reserves of oil, gold, Chinese yuan, and crypto in a scramble to salvage a nation in economic freefall.

In response, the US has begun to consider implementing sanctions on Russian use of digital assets. However, as analysts have pointed out, the liquidity in the industry at present is vastly insufficient to cater for transacting a nation’s assets, especially one as monolithic as Russia. Furthermore, as the blockchain is a publicly visible and traceable ledger by design, it is by no means a suitable technology for major geopolitical entities wishing to circumvent international sanctions.

Takeaways

As tensions between NATO and Putin’s regime continue to escalate, it’s reasonable to be perplexed by the bullish price action pervading crypto at present. However, on further reflection, its relative strength in the face of a conflict-ridden macro landscape could - just maybe - provide some indication that Bitcoin can in fact act as a safe haven asset in a time of incredible uncertainty. There’s a long way to go yet, but it’s promising to see that BTC and other cryptos being put to good use - to help those most vulnerable at a time when traditional finance institutions cannot.