Rise of the safe-haven JPEG?

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Only a week into the new year, the world of crypto is flush with volatility and high drama. Having opened 2022 in the $46k region, Bitcoin finds itself tapping range lows at $42k as uncertainty abounds. The ~10% drawdown comes after news that the US Federal Reserve has adopted a more aggressive stance to tapering rising inflation, with tradfi markets also falling as a result. However, one sector seems to have missed the boat of bearish sentiment – NFTs.

The second non-fungible boom

Since NFTs first gained major traction as an asset class in mid-2021, the industry has undergone a mini bear market of sorts. First-mover favourites, such as Lazy Lions and Pudgy Penguins, remain multiple ETH below their September floor prices, while CryptoPunks have fallen from favour as the Bored Ape Yacht Club (BAYC) ecosystem cements itself as the leading NFT collection.

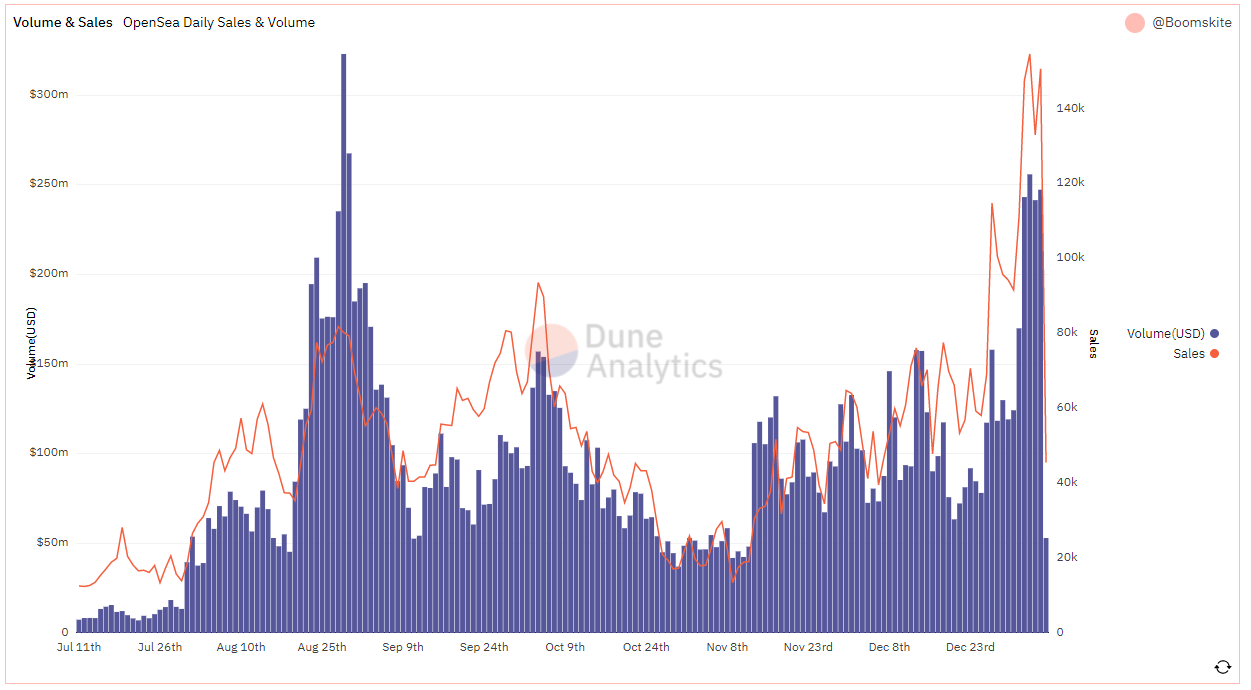

In the face of languishing volume on Opensea, the world’s leading NFT marketplace, January kicked off with trading volume not seen since August, propelled in part by aggressive interest in BAYC products.

Opensea has started the year with record sales and massive volume

Catalysts

To make sense of the major catalysts propelling current volume, it’s necessary to understand BAYC’s dynamics. The collection of 10k generative bored apes launched in April 2020 at a price of 0.08 ETH (roughly $200 at the time) and has since exploded to a 67 ETH (>$220k) floor – an almost 1000x ROI. Holders of Bored Apes were subsequently airdropped a “mutant serum” with varying degrees of rarity (M1, M2, M3), which allowed individuals to transform their apes into mutants, thereby minting another NFT.

M3 serum, the rarest by far, garnered a sale of 888 ETH on 26 December, with two further sales commanding prices of 999 ETH and 1542 ETH respectively. Over this week, an eye-watering offer of 1645 ETH (~$5,5m) for the prized NFT has gone unaccepted, in a show of, perhaps too much, brazen conviction in the brand’s longevity.

M3 Serum sales, Opensea

The market responded to the record-breaking sales with a voracious appetite for diving risk-on into NFTs despite macro uncertainty. The 20k-strong Mutant Ape collection has surpassed even apes themselves as the most highly traded collection on OpenSea, with the price floor exploding from 4 ETH to above 15 ETH at the time of writing. Even Bored Ape Kennel Club, a collection of digital dogs gifted to ape holders, has seen tremendous gains, currently commanding a >5 ETH floor as investors view it as the most affordable means to gain exposure to a highly exclusive brand.

A blitz of influence

BAYC has done an excellent job of establishing itself as a brand with significant social capital. Twitter accounts with Bored Ape profile pictures regularly command more than 10k followers, with some capitalizing on the opportunity to launch and promote their own projects.

The entrance of $3,4B crypto concierge platform, MoonPay, has only served to elevate this perception. MoonPay has positioned itself as a main driver of NFT adoption through exposure via celebrity ownership. Armed with a war chest of $555m in Series A funding, the outfit has facilitated the purchase of Bored Apes for high profile personalities, including the likes of Post Malone, Jimmy Fallon, Snoop Dogg, and most recently Eminem.

Guess money can’t buy everything

Small markets move rapidly

One can hold NFTs in high regard as a disruptive technology, while also rightfully balking at the exorbitant prices of the sector’s most expensive wares. However, the success of Bored Apes, whether we like it or not, currently maintains a strong correlation with faith in generative collections. Further, as a microcosm of the exponentially larger crypto industry, the dynamics of NFT speculation move in very similar ways to overall market cycles, albeit on far tighter time horizons. The renewed influx of interest has bolstered general demand, with double-to-triple digit ETH BAYC sales resulting in a wealth of free liquidity to flow to smaller projects. The rapid rise of newer collections, like Doodles and Cool Cats, evidences this understanding, with both now commanding floors above 8 ETH.

Top collections by volume, Opensea

Final thoughts

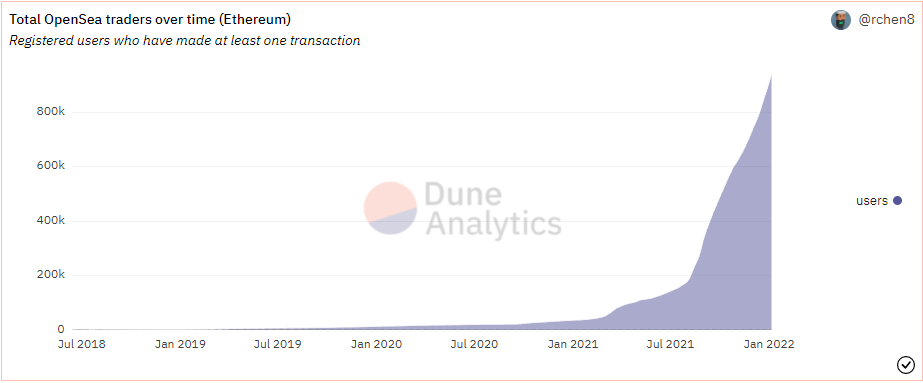

Though regular, good old fungible crypto accelerates aging, NFTs strap time to a rocket ship. This is largely because the market remains mostly untapped, with active traders on OpenSea still approaching the 1m user mark. The upcoming launch of Coinbase’s long-awaited NFT marketplace, as well as Twitter verification for NFT profile pictures, are sizeable catalysts that should see further adoption in the short-term. However, with macro markets facing increased uncertainty, it’s important to remember that non-fungibles, as a high-risk, less liquid asset class, could bear the brunt of investor pessimism as traders seek to reduce their exposure. That the sector has fared this well despite market-wide drawdowns is both surprising and inspiring for NFT enthusiasts across the board.

If you were hoping for a calmer year than the past 12 months, you may have to keep waiting until 2023.

*Adoption intensifies*