‘Tis the season to be bullish?

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

It’s been a tough three months for crypto. As the year draws to a close, BTC finds itself nearly 30% down from October’s $69k all-time highs (ATH). However, following a rapid wick down to $40k in early December, the leading crypto seems to have found solid support in the $45k-$46k region, and is once again knocking on the door of the hallowed $50k. With the impact of Evergrande’s folding starting to dissipate, and a general shift in sentiment over the past week, a new narrative has taken hold – will we see a “Santa rally”?

Of course, we’ve seen similar narratives emerge during downtrends before. From “Wall Street bonuses” to “Chinese New Year”, seasonal theses have not aged well in the world of cryptocurrency investments. However, as we’ve come to learn, this time has been different. With PlanB’s Stock-to-flow model potentially invalidated for the first time since its inception in 2013, and large wallets continuing to accumulate since May’s crash, the idea of a “super-cycle” has become increasingly plausible. The super-cycle theory, put simply, posits that with the influx of institutional investment and changes in long-term holder behaviour over the past year, we could see BTC enter a multi-year bull cycle, with 2022 potentially seeing a further rise that could dwarf previous bull runs.

As Glassnode explained in a recent tweet, illiquid supply of BTC has also seen a rapid rise since September, despite the exaggerated volatility that has marked recent months.

Dominance

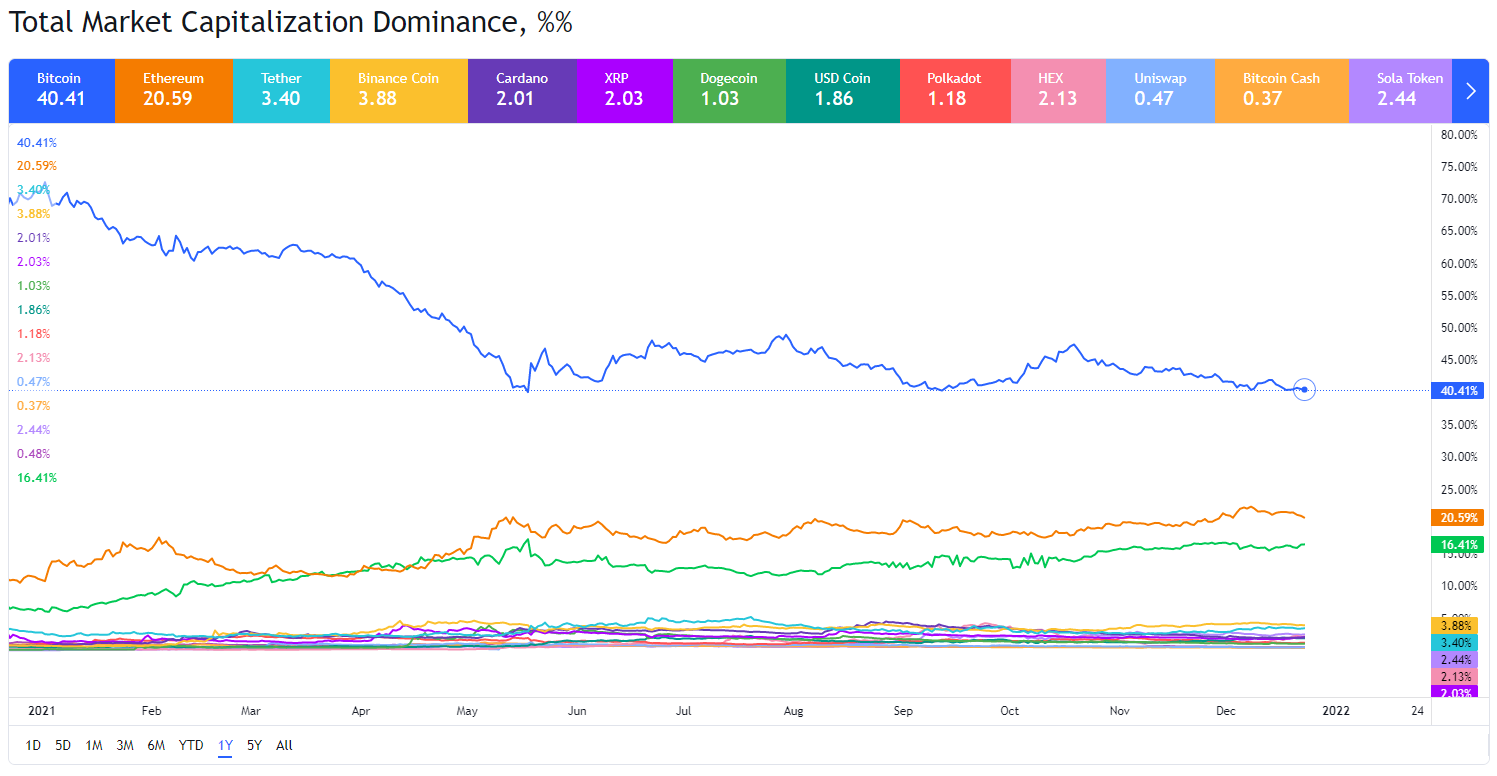

Dominance paints an interesting picture. BTC currently claims a 40% share of the market – once again scraping May lows as alts enjoy increased gains despite ongoing uncertainty. ETH, for the time being, is holding steadfast above 20% market share, while smaller alts constitute 16% of the overall market. Should BTC wrangle its way back above $50k, it’s reasonable to assume that dominance may increase sharply, at least in the short term, as investors rotate back to BTC in anticipation of further movement. However, should dominance break below 40% (for the first time since the tail-end of 2017’s run), we could see a rapid, “mini” alt season, preceding a further drop for the overall market, as was the case in previous runs.

Courtesy of TradingView

Looking forward

Blockchain adoption has continued to accelerate at a rate only rivalled by the internet in the early 2000s. It’s estimated that annual adoption is increasing at a rate of 80%, which could see crypto adoption reach 1B users by 2025. Recent activity suggests that large holders may well be accumulating with an extended cycle in mind, with ~26k BTC moved off exchanges on 22 December alone.

Whether Santa chooses to leave lambos or rugs under the tree this year remains to be seen, but metrics tentatively suggest that early 2022 could see fresh fields of green.

Merry Christmas! (NFA)