What just happened?

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

It’s been, quite frankly, an unprecedented week for crypto. With Terra’s UST depegging and LUNA’s $40B market cap being erased in a matter of days, never before has the space witnessed the collapse of a stablecoin so large and deeply entrenched in the broader market.

The confluence of Do Kwon’s fall from grace, another concerning CPI print, and cross-sector macro bearish sentiment has resulted in a storm of downward volatility that has seen the total crypto market cap shed $300B at the time of writing - a one week decline of almost 20%.

The stable that wasn’t

As discussed in late April, Do Kwon’s hybridisation of Terra’s algorithmic stablecoin, UST, through the purchase of $3B in BTC as backing, has proved to be a short-lived, and calamitous, experiment.

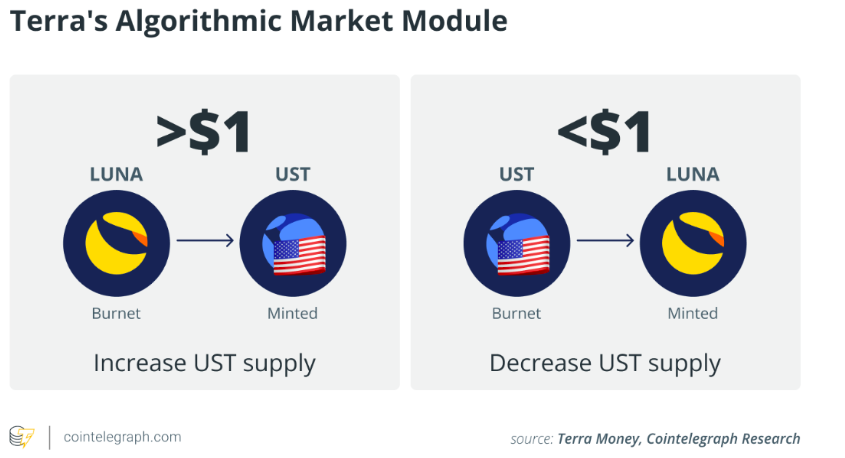

Before we dive in, let’s recap the basic principles of the Terra protocol’s algorithm.

Stablecoins generally can be classified as either collateralised or algorithmic.

Collateralised stablecoins are backed 1:1 by fiat cash reserves, with the two most prominent examples being USDC and USDT. Theoretically, at any point, these stablecoins can be redeemed for dollars at a 1:1 rate due to the underlying collateral. However, this system presents issues as it requires trust in a centralised entity in a fundamentally decentralised space.

Algorithmic stablecoins, conversely, have been developed as a decentralised alternative to traditional stables, and aim to maintain a 1:1 dollar peg purely through algorithmic regulation. On a basic level, this is achieved through reducing supply when peg falls below a dollar to increase demand, and increasing supply when above $1 to reduce the price and hold its peg. Until last week, LUNA & UST were firmly positioned as the space’s premiere algo stable protocol.

High-level overview of UST’s algorithm

Luna’s fall from grace

Terra founder Do Kwon attempted to increase the stability of UST’s peg by amassing a store of 42k BTC in recent weeks, buying all the way up to the local top at $48k. On Sunday, in the midst of a market-wide drawdown, UST began to lose its peg. In response, Do Kwon tasked monolithic market makers, Three Arrows Capital (3AC) and Jump , with defending the UST peg by selling off 30k ETH (roughly $70m at the time). However, this proved futile, with the peg slipping into free fall a day later and Luna’s value plummeting in tandem. Being faced with little other choice, Do Kwon was forced to sell off the entirety of the Luna Foundation Guard’s BTC treasury, prompting a retracement for BTC all while doing little to support the sinking stable. Just three days later, Luna now sits a hair above $0.01 - a four day decline of %99.98 on what was very recently a $40B token. The impact of this failure on the market has been swift, violent, and widespread.

Why?

It’s important to remember that as the third largest stablecoin in crypto, UST has embedded itself in DeFi protocols across networks. The recent crash has thrown every protocol entwined in UST off kilter, with liquidity pools being gravely imbalanced, leaving market participants scrambling to limit the contagion effect of the crash.

LUNA vs UST price action over the same timeframe

BTC vs UST price action over the same timeframe

Forging a path forward

By many metrics, this drawdown, in the midst of an arduous macro environment last observed in 2008, could signal the start of a deep bear market. For fresh entrants, recent days have likely been a severe shock to the system. As cliched as it's become, it’s vital to understand that crypto has been here before, albeit with different complexions, at the end of previous cycles, as witnessed in 2013 and more recently in 2017’s historic run.

Finding oneself abruptly underwater in a downtrending market can carry a significant emotional toll, making it vital to prioritise mental health and well-being. While many of us may be so deeply entrenched in the market that always-on has become a way of life, it’s easy to neglect the psychological consequences of such sudden, and severe, events. The world is larger than crypto, and if you’ve been affected by recent volatility, it’s of paramount importance that you reach out to those you can trust and work through the emotions brought on in recent days.

This too shall pass, though there isn’t an analyst out there who could pinpoint exactly how this plays out, and for how long. Regardless, builders will continue to build tirelessly, and should the bear market prove to be prolonged, we will see serious projects show their true strength and many that fall to the wayside, potentially providing excellent buying opportunities as a result.

This is a time for patience, introspection, and research. These lessons, as earth-shattering as they may be at present, allow us space to reevaluate strategies and emerge better traders with a far broader understanding of market dynamics. It’s been a tremendously difficult week, but if crypto’s 13-year history is anything to go by - the market will rebuild, with force. It’s merely a matter of when.