When boom turns to bust

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Another week, another admission that we are teetering on the verge of a global financial crisis of historic proportions. Fed chair, Jerome Powell, reiterated his commitment to reining in inflation rates on Wednesday, evidencing a markedly hawkish stance. Powell’s latest speech rejected the idea of slipping into an “inflation regime” - and is prepared to take whatever action is necessary to regain economic stability, even if that means falling equities and the looming prospect of a recession. Markets responded with deep retracements on Thursday, with many starting to feel the severity of the current macro climate. At the time of writing, BTC sits on the brink of $19k.

Correlations

As the impact of the macro climate becomes increasingly tangible, risk assets have only tightened their correlation. At present, BTC essentially trades as a beta to major indices (SPX, NDX, DJI), with equity drawdowns precipitating crypto retracements. For this reason, the opening of the US session (15h30 SAST) generally brings with it a rush of volatility that many traders monitor closely.

Given the Fed’s decidedly hawkish outlook, and no visible signs of inflation peaking yet, it’s unlikely that BTC decouples in any meaningful way in the short term - barring some form of black swan event.

BTC overlaid with SPX, DJI, NDX

Liquidations loom

Arduous macro conditions aside, the contagion effect of Luna’s crash and 3AC’s insolvency is still making itself known. On Monday, crypto broker Voyager Digital issued a notice of default to 3AC for failing to service a $665m loan. A host of other entities have similarly faced massive losses, with Digital Currency Group (DCG)’s market maker, Genesis Trading, incurring losses in the hundreds of millions partly due to their exposure to 3AC. Additionally, BlockFi has run aground after efforts to liquidate 3AC’s $1B position went sideways due to $400m being locked in the Grayscale Bitcoin Trust, which currently trades at a significant discount to spot BTC.

Right now, many market participants probably wish they had three eyes - one to monitor macro, one to monitor 3AC contagion, and one firmly fixated on Celsius’s $500m BTC collateral set to be liquidated at $13k.

Forward focus

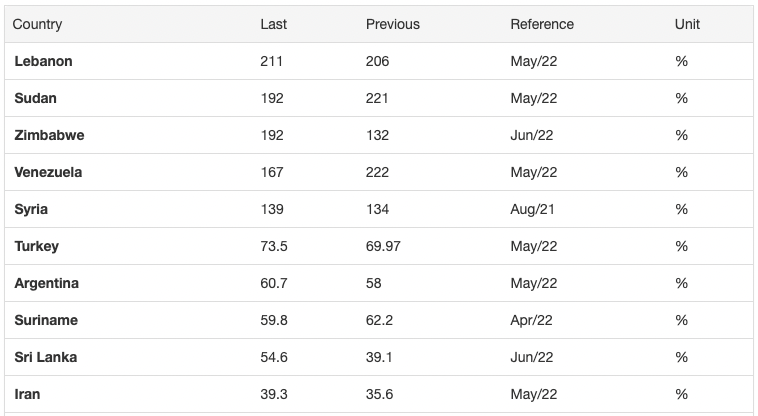

The current picture is not a happy one, but it is an honest one. Even the most battle-tested veterans among us are in uncharted waters, with Bitcoin dropping below its previous cycle ATHs for the first time since its inception. By and large, the technical indicators and patterns leaned on by day traders have fallen by the wayside as macro impacts increase in severity. A look at inflation globally provides a searing example of the current state of our economies.

Top 10 inflation rates by country (tradingeconomics.com)

When costs of living soar and wages do not, people naturally turn from speculation and risk to protecting assets. The outflows from the crypto space in recent weeks, coupled with declining volume, evidence this prevailing sentiments of fear and uncertainty. It’s anyone’s guess how long it will take to regain some semblance of economic stability, but it’s reassuring that the Fed has finally taken a firm stance on forging a path to combat the present problem. While the process is likely to be painful and possibly prolonged for many, under the current financial system, this marks the only viable means to prevent further fiat debasement going forward - or so they say.