Whose decentralisation is it anyway?

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

With bitcoin rejecting $40k support, the leading asset now finds itself teetering on the brink of the lower bounds of the trading range that has dominated 2022. Despite a flurry of bullish news, including investment firm monolith Fidelity adding Bitcoin to its 401k offering, price action has maintained a steady decline, save for brief spikes following Elon Musk’s acquisition of Twitter on Monday, which saw DOGE rally 20% on the day and BTC briefly reclaim its $40k footing, before retracing further.

The Elon Paradox

It’s inarguable at this stage that Musk has perhaps the greatest influence on markets at present. Despite being aware of this, he has continued on his quest of serial market manipulation, gleefully memeing while millions of his followers lost considerable amounts to his DOGE maximalism and questionable understanding of blockchain architecture.

Clearly, however, commanding a following of 88.5 million on Twitter does not constitute sufficient influence for the emerald mining heir. To this end, Musk has outright acquired Twitter for $44B under the guise of “protecting freedom of speech”.

Let’s dispel that myth right away.

When analysing any public figure, words are vacuous at best, necessitating an exploration of their actions as a true judge of character. In Musk’s case, his relationship with freedom of expression is tenuous at best. Let us remember that this is an individual who once personally cancelled a blogger’s Tesla order because he disapproved of their write-ups. Back in 2018, Musk needlessly injected himself into rescue operations for trapped Thai students by offering a clearly impractical “submarine” to expedite the mission. Due to the complexity of the cave system, his “solution” can be chalked up to little more than a publicity stunt. After having his offer rebuffed, Musk took to Twitter in an inexplicable tirade by calling the dive team lead a paedophile. Earlier this year, he attempted to buy out and shut down the account spun up by a teenager that tracked his flight data.

Which begs the question: why, in a decentralised space, would we celebrate the privatisation of a public platform by the world’s wealthiest individual? In what way does deifying someone who has amassed a fortune larger than many countries’ GDPs off the backs of exploited Gigafactory workers, and children mining his Lithium and Cobalt, pave the way for a better financial paradigm that serves the interests of humanity as a whole?

It does not.

Takeaways

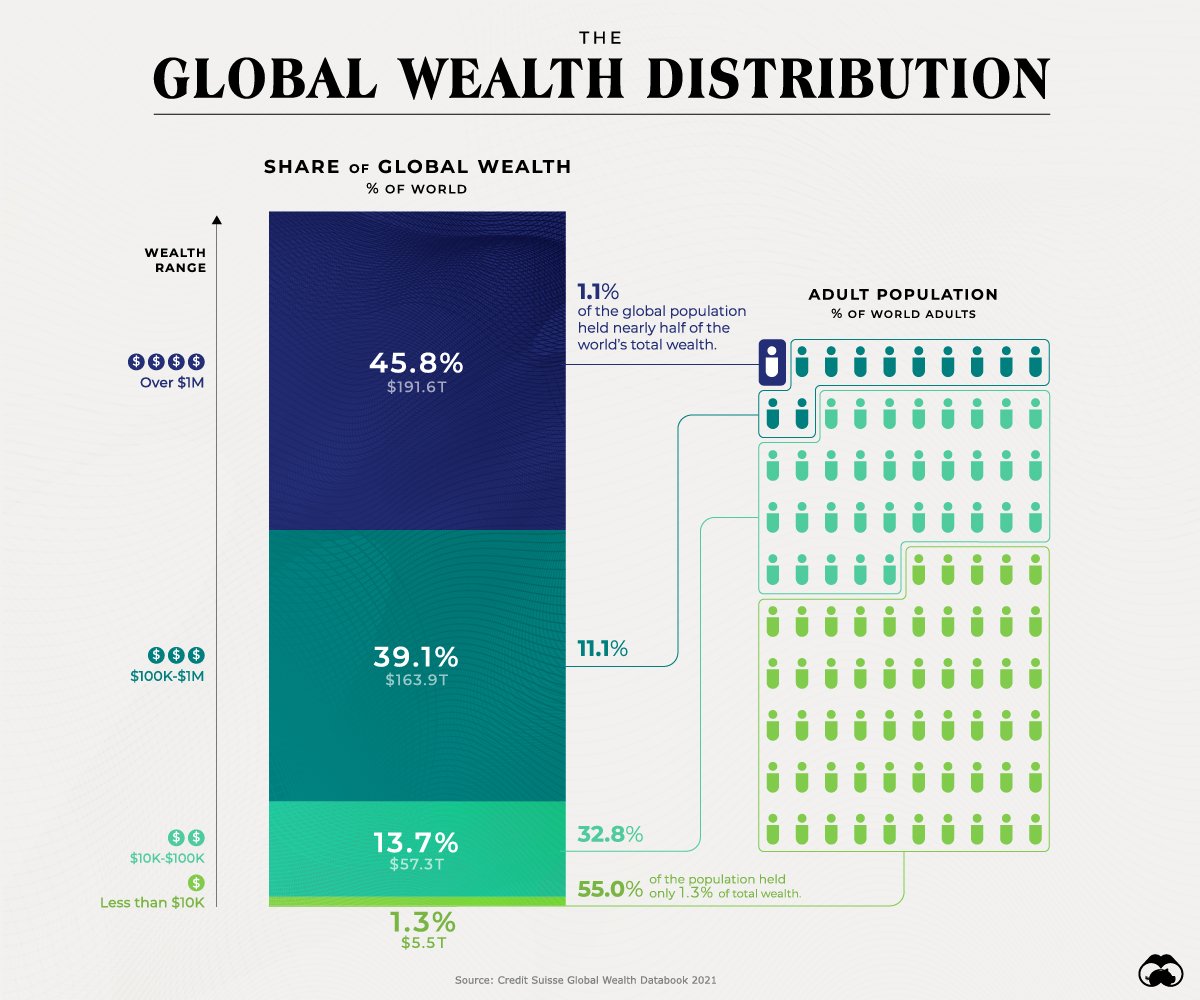

Profit maximalism for profit’s sake is exactly why we’ve found ourselves in our present situation, with ever-growing wealth inequality and countries across the globe facing spiralling inflation and economic instability. Where, at one end, we have the likes of Musk and Bezos commanding more wealth than could be spent in a hundred lifetimes, while half the world’s population starves.

If the vision of blockchain truly is what we believe it should be - an inclusive means of transacting resting on the immutable pillars of democratisation and decentralisation - we cannot afford to let the old guard impose its will on a monetary system conceived by the people, for the people. In much the same way that Zuckerberg’s Meta is diametrically opposed to the ethos of NFTs, Musk’s influence has wreaked havoc on the market over the past two years through manipulative half-truths and false flag environmental concerns.

In this writer’s mind, only once we are able to divorce ourselves from blind adulation for the 0.1%, including the Do Kwons and Justin Suns of this space, can crypto begin to flourish and truly serve the people.

VisualCapitalist