Bitcoin Halving 2024: What Is it and How Will it Impact the Crypto Industry?

Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

The Bitcoin halving is among the most important crypto industry events of the year. Considering its significant impact on cryptocurrency prices, this shouldn't be surprising.

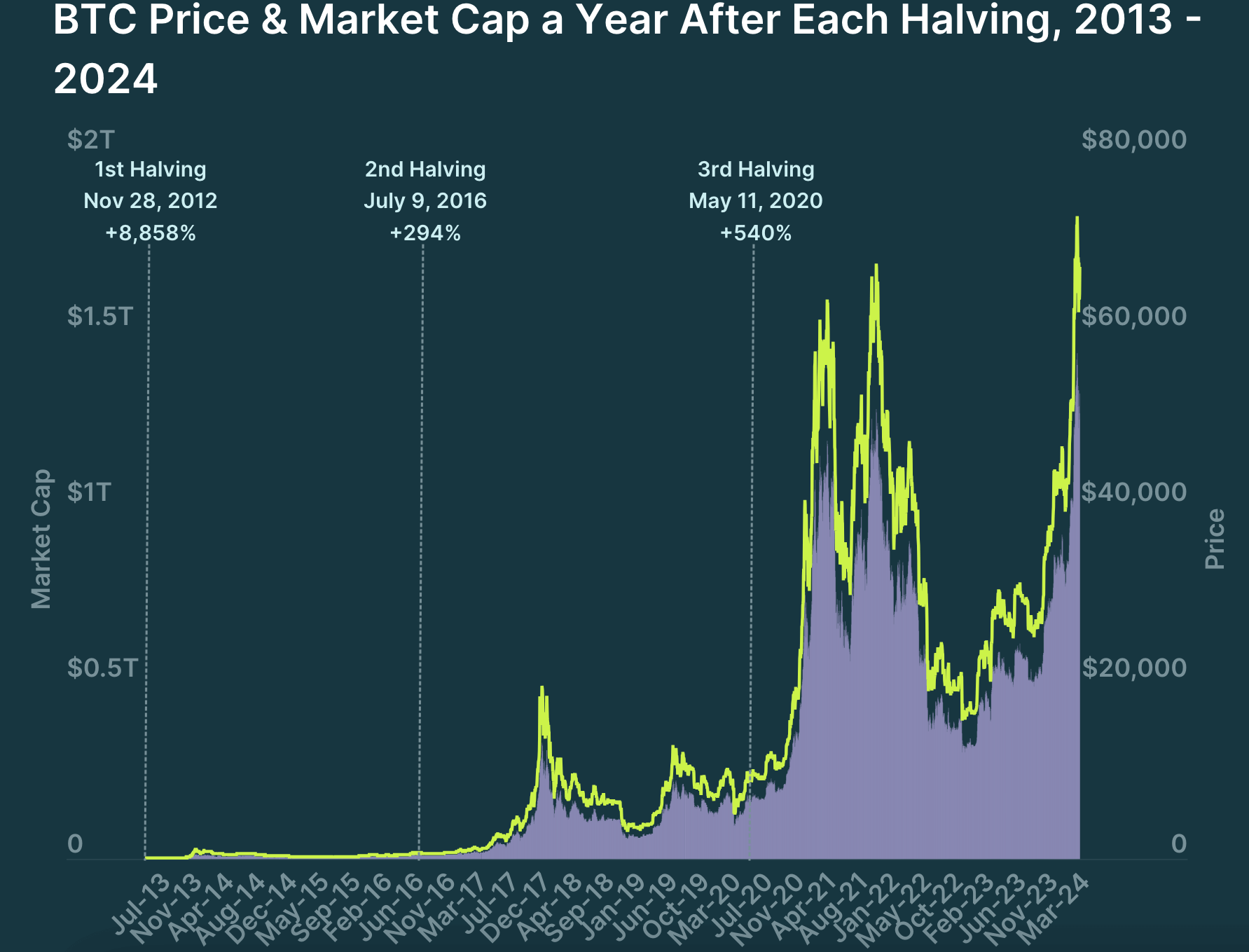

The last halving in May 2020 triggered a post-halving bull run of over 660% for BTC, increasing the total crypto market capitalisation from $235 billion to as high as $2.93 trillion by November 2021.

Having sparked bull cycles in previous years, the Bitcoin halving also greatly affects network hashrate and miners' revenue. In this article, we will explore what the Bitcoin halving is and what to expect from the upcoming halving.

What Is the Bitcoin Halving?

The Bitcoin halving occurs roughly every four years or after every 210,000 blocks. It functions as a deflationary mechanism by reducing block rewards by 50%. In other words, miners will only receive half of the bitcoins they previously received for mining a block, leading to a substantial drop in Bitcoin’s annual inflation rate.

This year's Bitcoin halving is expected to take place in April 2024 when the block height reaches 840,000. You can track the current countdown here.

According to the law of supply and demand, the decrease in the new BTC supply is expected to potentially increase Bitcoin’s price if the demand for BTC stays the same or grows. Historically, this has led to post-halving bull runs, serving as a catalyst for rising cryptocurrency prices and new market trends.

Bitcoin halvings will continue, and miners will receive BTC as block rewards for creating new blocks and verifying transactions until the maximum supply cap of 21 million BTC is reached. Currently, according to CoinMarketCap, 19.68 million BTC is in circulation, representing 93.7% of the total supply.

The Potential Impacts of the Upcoming Bitcoin Halving

Historically, the Bitcoin halving has triggered major crypto market bull runs and caused short-term challenges for miners.

Catalyst for a New Crypto Bull Run

The halving typically leads to pre- and post-halving bull runs for BTC and the broader cryptocurrency market. One of the reasons for this is a significant change in Bitcoin’s supply and demand dynamics. But will the 2024 halving have the same effect? Only time will tell.

Short-Term Challenges for Miners

The Bitcoin halving generally presents challenges for miners, at least in the short term. As block rewards are halved, miners can only generate half the amount of BTC they could before the halving. This adjustment makes mining less profitable, particularly for individual miners or pools operating with outdated equipment or narrower profit margins.

For example, in the upcoming halving, block rewards will decrease from the current 6.25 BTC to 3.125 BTC. At the current price of $72,000 per BTC, this means that miners will generate only $225,000 instead of the previous $450,000 they earned. Since Bitcoin is not expected to double in price immediately following the halving, miners may face decreased revenue, potentially resulting in losses.

Thus, many miners, especially those with lower profit margins, may pause BTC mining temporarily after the halving and resume once Bitcoin's value increases to a profitable level. As a result, the network hashrate is likely to experience a temporary decline as miners adjust their strategies to cope with reduced block rewards.

Is a New Bull Market Cycle Imminent?

While halvings have historically been followed by bull markets, it’s not the only determinant of Bitcoin's price. Market sentiment, adoption, macroeconomic factors, regulatory developments, and technological advancements also play crucial roles in influencing the price of Bitcoin.

The approval of spot Bitcoin exchange-traded funds (ETFs) in the US earlier this year has contributed to positive trends in Bitcoin's adoption, with 4.74% of the total BTC supply already held by ETFs and other funds. Perhaps we're already in a new bull market cycle, given that the price of Bitcoin has surged by 68.68% in Q1 of 2024 alone.

Frequently Asked Questions (FAQ)

-

Bitcoin halving is a deflationary mechanism that reduces the new supply of BTC by 50% roughly every four years.

-

While the halving will reduce block rewards to 50%, this does not mean BTC's price will be halved. However, the period leading up to and following the halving often sees increased price volatility due to heightened anticipation.

-

The next Bitcoin halving is expected to take place in April 2024, when the block height reaches 840,000.

-

The last Bitcoin halving took place on May 11, 2020, when block rewards decreased from 12.5 BTC to 6.25 BTC.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate.

VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).