VALR Blog

Top 10 DePIN Use Cases for 2026

Decentralised Physical Infrastructure Networks (DePIN) use blockchain and token incentives to crowdsource telecom, AI, energy, and cloud infrastructure. With 13M+ daily devices and a projected $3.5T opportunity by 2028 (via the World Economic Forum), DePIN is shifting infrastructure from corporate-owned to community-built.

Inflationary vs. Deflationary Crypto: An Explainer

Inflationary cryptocurrencies like Dogecoin increase supply over time to boost liquidity and network activity. Deflationary assets like Bitcoin limit or reduce supply to create scarcity and support long-term value. Understanding inflationary vs. deflationary crypto helps investors choose between utility and store-of-value potential.

zk-SNARKs vs. zk-STARKs: A Beginner's Guide

Zero-knowledge proofs (ZKPs) enhance blockchain privacy and scalability by verifying transactions without revealing data. Compare zk-SNARKs, used by Zcash, and zk-STARKs, powering StarkNet, in efficiency, security, and quantum resistance.

Understanding Crypto Market Cycles: A Practical Guide to Bull Run Preparation

Learn how to identify crypto bull runs, track market cycles, and use key indicators to invest smarter in Bitcoin and altcoins.

Permissioned vs. Permissionless Blockchains: What Is the Difference?

Permissionless (Bitcoin, Ethereum): Open access, no approval. Decentralized, transparent, pseudonymous, trustless. Powers DeFi, NFTs, crypto. Slower but censorship-resistant.Permissioned (Hyperledger, Corda): Restricted/KYC access. Fast, private, scalable, regulation-friendly. Built for enterprise (supply chain, banking, healthcare). Less decentralized.

How to Send Money From South Africa to Tanzania

A step-by-step guide to send money from South Africa to Tanzania with VALR Pay.

How to Send Money From South Africa to Ghana

A step-by-step guide to send money from South Africa to Ghana with VALR Pay.

How to Send Money From South Africa to Netherlands

A step-by-step guide to send money from South Africa to Netherlands with VALR Pay.

How to Send Money From South Africa to Ethiopia

A step-by-step guide to send money from South Africa to Ethiopia with VALR Pay.

How to Send Money From South Africa to Pakistan

A step-by-step guide to send money from South Africa to Pakistan with VALR Pay.

The Oracle Problem: Why Blockchains Need a Bridge to the Outside World

Blockchain oracles connect smart contracts to real-world data, enabling DeFi price feeds, insurance payouts, and cross-chain operations. Decentralised oracle networks prevent single points of failure, making on-chain apps more secure and reliable.

What Are Decentralised Identifiers? A Guide to Web3 Identity

Web3 digital identity replaces fragile, centralized logins with self-sovereign IDs using Decentralised Identifiers (DIDs) and Verifiable Credentials (VCs). This user-controlled model boosts privacy, reduces data breaches, and enables secure, passwordless verification across platforms. As digital identity becomes essential worldwide, decentralised identity offers a safer, more inclusive future.

Bitcoin vs. Fiat vs. Stablecoins: The Modern Cantillon Effect

The Cantillon Effect shows how money creation benefits those closest to the source, driving asset inflation while wages lag. Bitcoin’s capped supply and decentralized issuance offer a fairer alternative, while stablecoins provide global access to stronger currencies.

On-Chain vs. Off-Chain Transactions: What Is the Difference?

On-chain vs. off-chain transactions define how blockchains balance security, speed, and cost. On-chain data is recorded directly on the blockchain for maximum trust, while off-chain solutions process transactions externally to improve scalability and efficiency.

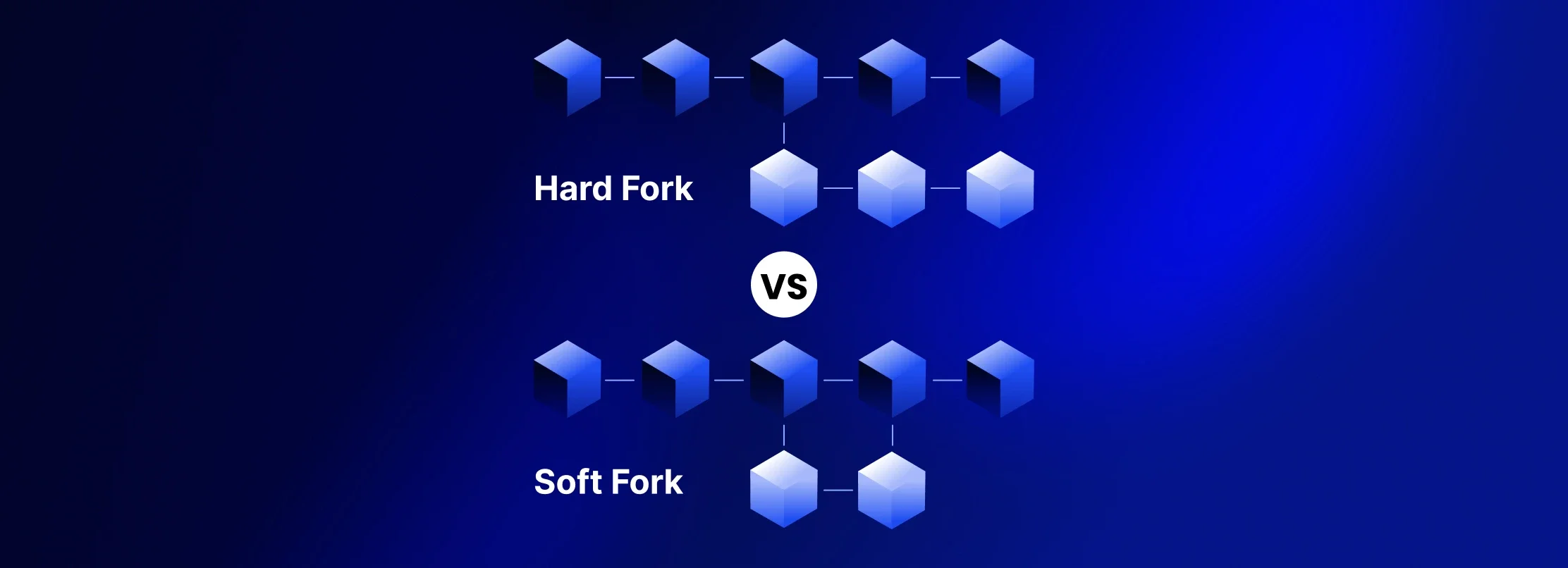

What is a Fork in Crypto? Hard Forks vs. Soft Forks Explained

Blockchain upgrades can lead to a fork, a split in the network. A hard fork creates a new chain and often a new coin, while a soft fork updates the protocol without splitting the blockchain. Learn how forks work, why they happen, and what they mean for your crypto holdings.

How to Buy Illuvium (ILV) in South Africa

Follow these steps to purchase Illuvium easily and securely on VALR: 1. Create an account or sign in 2. Deposit ZAR into your account 3. Buy ILV

How to Buy Memecoin (MEME) in South Africa

Follow these steps to purchase Memecoin easily and securely on VALR: 1. Create an account or sign in 2. Deposit ZAR into your account 3. Buy MEME

What Are Social Tokens? Examples and Top Coins to Watch

Explore how social tokens (SocialFi) are transforming the creator economy. From Gravity (G) to DESO and Steem (STEEM), these blockchain assets let creators monetise directly, engage fans, and build decentralised communities in Web3.

How Crypto Structured Products Are Simplifying Digital Asset Investing

Crypto structured products make crypto investing simpler by bundling multiple digital assets into one diversified investment. They offer easy, passive exposure to major cryptocurrencies, helping investors manage risk, diversify portfolios, and access professional strategies without managing individual coins.

What Are Crypto Prediction Markets? A Guide to Decentralised Forecasting

Crypto prediction markets turn opinions into tradeable assets, letting users buy and sell shares on outcomes like elections, Bitcoin prices, and economic events. By aggregating real-money sentiment on decentralised platforms like Polymarket and Kalshi, these markets often outperform traditional polls and are emerging as a powerful tool for forecasting in 2026.