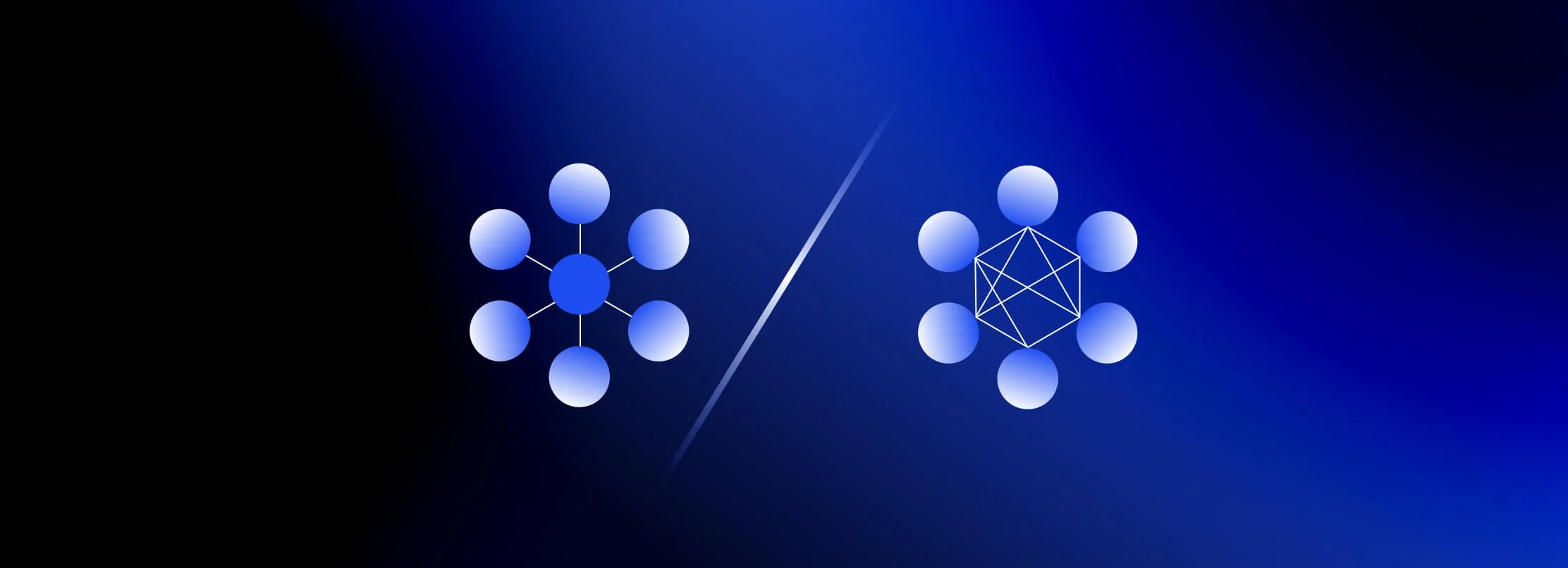

CEX vs. DEX: A Guide to Centralised and Decentralised Exchanges

When I first started paying attention to crypto trading, I felt like I'd wandered into a conference where everyone was speaking in acronyms and assuming I knew the difference between a CEX and a DEX. Both are essentially marketplaces for buying and selling cryptocurrency, but they operate on completely different philosophical and technical foundations that affect pretty much everything about your trading experience.

The choice between centralised and decentralised exchanges isn't just about personal preference—it fundamentally shapes how you custody your funds, what assets you can access, how much you'll pay in fees, and whether you're comfortable with various trade-offs between convenience and control. Put simply, a centralised exchange is run by a company that holds your crypto for you, while a decentralised exchange lets you trade directly from your own wallet without anyone else controlling your funds.

I'm going to break down what distinguishes centralised from decentralised exchanges, explore the practical implications of each approach, walk through the security considerations, and explain how platforms like VALR fit into this evolving landscape.

What Is a Centralised Exchange (CEX)?

A centralised exchange (CEX) is a platform operated by a central company or entity that acts as a trusted intermediary between crypto buyers and sellers. Think of it like a traditional stock exchange but for digital assets. When you use a CEX, you deposit your funds (both fiat currency and crypto) into an account or wallet managed by the exchange. The CEX then holds custody of these assets and facilitates trades through an order book system, matching buy and sell orders from its users.

Platforms like VALR, Binance, Coinbase, and Kraken are prominent examples of CEXs. They are popular because they typically offer user-friendly interfaces, high trading volumes (liquidity), and a wide array of digital asset services, including advanced trading options like crypto futures and margin trading.

CEXs often serve as the primary on-ramp for users looking to convert traditional currencies into cryptocurrencies. As of Oct 22, 2025, the total 24-hour trading volume across CEXs reached an impressive $256 billion, significantly outpacing that of their decentralised counterparts.

Pros and Cons of a Centralised Exchange (CEX)

| Pros | Cons |

|---|---|

| User-friendly, excellent for beginners | No full control over your funds |

| High liquidity & fast transactions | Counterparty risk |

| Fiat on/off ramps | Requires KYC |

| Customer support available | Potential for downtime and service interruptions |

| Reputable CEXs offer regulated services | Trading activities are centrally recorded |

| Wide range of trading pairs & features | On some platforms, fees may be higher than at some DEXs operating on high-throughput blockchains |

| Often offers more advanced trading tools | Trading volumes may be subject to wash trading and internal trading risks |

| No network fees for trading |

What Is a Decentralised Exchange (DEX)?

A decentralized exchange (DEX) is a trading platform that runs entirely on blockchain code without any company controlling it, allowing you to trade cryptocurrencies directly with other users from your own wallet. Instead of depositing your crypto with an exchange like you would with a bank, you keep full control of your funds in your personal wallet and only release them when you actually complete a trade. Think of it like a peer-to-peer marketplace where the blockchain acts as an automated middleman, executing trades through pre-programmed rules rather than human operators.

Instead of traditional order books, many DEXs use Automated Market Makers (AMMs). AMMs employ liquidity pools (pools of token pairs funded by liquidity providers) and mathematical formulas to determine asset prices and execute swaps. Examples of popular DEXs include Uniswap, PancakeSwap, and SushiSwap.

DEXs are integral to the DeFi ecosystem, offering permissionless access to trading. While their adoption is growing, as of Oct 22, 2025, the total 24-hour trading volume on DEXs was $14.6 billion, which is about 5.4% of the volume seen on CEXs during the same period.

Pros and Cons of a Decentralised Exchange (DEX)

| Pros | Cons |

|---|---|

| Full control over your funds | Can be complex for beginners |

| Trade or swap coins directly without intermediaries | Potential smart contract risks |

| Enhanced privacy without KYC | Lower liquidity for some pairs and increased risks of slippage |

| Access to a wider range of new or niche tokens | No fiat on/off ramps or the service is provided via external providers |

| On-chain trading | No customer support |

| Transparency and traceability | You have to cover the network fees and the protocol fees of each trade (and gas fees can be high on some networks) |

| Integrated deeply into the decentralized finance (DeFi) ecosystem | The user is fully responsible for securing his own private key |

| Potentially lower trading fees than on some CEXs |

Decentralised vs. Centralised Exchanges: The Key Differences Between DEXs and CEXs

While both CEXs and DEXs allow users to trade cryptocurrencies, their operational models lead to fundamental differences in how they function and what they offer. Understanding these distinctions is key to choosing the platform that best suits your trading needs and risk appetite.

Centralised Exchange (CEX) vs Decentralised Exchange (DEX)

| Feature | Centralised Exchange (CEX) | Decentralised Exchange (DEX) |

|---|---|---|

| Custody of Funds | The exchange holds user funds (custodial). You trust the exchange to secure your assets. | The user retains control of funds in their personal wallet (non-custodial). You control your keys. |

| Privacy (KYC) | Requires KYC/AML identity verification due to regulatory compliance. | Often no KYC is required, offering greater privacy. Transactions are pseudonymous on the blockchain. |

| Liquidity | Typically high liquidity due to large user base and market makers, leading to tighter spreads. | Can vary; popular pairs have decent liquidity, but niche tokens might have lower liquidity & slippage. |

| Trading Pairs | Offers a wide, curated selection of established and vetted cryptocurrencies. | Often provides access to a broader range of tokens, including new and less-established ones. |

| User Experience | Generally user-friendly interfaces, often similar to trading platforms in the traditional finance industry. | Can be more complex, requiring understanding of wallets, gas fees, and blockchain interactions. |

| Fees | Trading fees set by the exchange; may include deposit/withdrawal fees. | Transaction fees (gas fees) paid to network validators and protocol fees. |

| Speed | Trades are often instant as they occur on the CEX's internal ledger. | Transaction speed depends on the underlying blockchain's confirmation times (block time) and congestion. |

| Security | Relies on the exchange's security measures; vulnerable to hacks if the exchange is compromised. | Security depends on smart contract code and the user's own wallet security. |

| Regulation | Subject to regulations in their operating jurisdictions; reputable platforms are licenced. | Largely unregulated or operates in a legal grey area. |

| Customer Support | Typically offers customer support channels (email, chat, etc.). | Usually limited or no direct customer support; relies on community forums and social channels. |

| Risks | Risk that the exchange itself could fail, be hacked, or mismanage funds. | Reduced counterparty risk as no central entity holds funds, but smart contract vulnerabilities still pose a potential risk. |

Use Cases: When to Use a CEX vs. a DEX?

Choosing between a CEX and a DEX often depends on your specific needs, technical expertise, and priorities.

Use a CEX if:

You are new to crypto and prefer a user-friendly interface.

You need to buy crypto with fiat currency (e.g., USD, EUR, ZAR) or cash out crypto to fiat.

You value having access to customer support.

You want to trade a wide variety of established cryptocurrencies with high liquidity.

You are interested in advanced trading tools, services, and features like futures, options, or margin trading, which are more commonly offered on CEXs.

You prefer trading on a platform that is subject to regulatory oversight.

Use a DEX if:

You prioritise having full control and self-custody of your private keys and funds.

You value privacy and prefer to trade without undergoing KYC procedures.

You want to access newly launched tokens or niche assets not yet listed on CEXs.

You are comfortable managing your own crypto wallet and understanding blockchain transaction mechanics.

You are deeply involved in the DeFi ecosystem and want to interact directly with on-chain protocols.

You are concerned about the censorship risk or potential for fund seizure on centralised platforms.

Many traders use both CEXs and DEXs, leveraging each for their specific strengths - for instance, using a CEX as an on-ramp to buy crypto with fiat, then moving assets to an external non-custodial wallet and leveraging a DEX for specific DeFi activities (e.g., crypto lending, yield farming, restaking) or to gain exposure to a wider range of tokens.

Security Considerations

Both CEXs and DEXs present unique security considerations. On a CEX, the primary risk is custodial or counterparty risk. Since the exchange holds your assets, you are trusting the platform to implement robust security measures to prevent hacks and to manage their operations soundly to avoid insolvency. If a CEX is compromised or fails, users can lose access to their funds, as has happened in several high-profile incidents in the past (e.g., the FTX disaster).

With DEXs, users maintain control of their funds, which mitigates custodial risk. However, the main security concern lies with smart contract vulnerabilities. DEXs operate via smart contracts, and if there are bugs or exploits in the code, these can be targeted by attackers, potentially leading to a loss of funds locked in those contracts. Additionally, users are solely responsible for the security of their own wallets and private keys; losing, forgetting, or compromising these means losing access to your assets with no recourse.

VALR: A Centralised Exchange (CEX) Model With Strong Compliance and Impeccable Security

VALR operates as a centralised exchange (CEX), prioritising a secure, compliant, and user-friendly trading platform for everyone, from crypto beginners to professional traders. We understand the importance of trust and security in the crypto industry.

Our commitment to security is multi-layered. We employ institutional-grade vaults for safe storage, utilising both cold storage for the majority of assets and secure hot wallets for operational liquidity. Internal controls are stringent, requiring multiple signatories for any fund movement—no single individual can unilaterally transfer cryptocurrencies.

Account security for our users includes mandatory Two-Factor Authentication (2FA) for critical transactions, with strong encouragement to upgrade to app-based authenticators, and authorisation for new device/location access. Financially, VALR operates on a full-reserve basis, meaning all customer assets are kept 100% fully reserved and are not lent out.

VALR has also achieved significant regulatory milestones. We are proud to be one of the first crypto asset platforms to receive regulatory approval in both Category I and Category II from South Africa's Financial Sector Conduct Authority (FSCA) as a Crypto Asset Service Provider (CASP). VALR also holds authorisations and registrations various regions such as the European Union (via Poland) and more.

Whether you're looking to make your first crypto purchase or trade crypto assets as a pro trader, VALR offers a comprehensive suite of tools, services, and products, including spot trading and futures trading. Moreover, you can also stake or lend your coins to generate additional revenue via the platform. At the same time, VALR Pay offers users instantaneous transfers with zero fees.

Ready to experience a secure, convenient, and regulated crypto trading platform?

Frequently Asked Questions

-

Neither is universally better; it depends on your needs. CEXs are more user-friendly, offer high liquidity, fiat on/off ramps, customer support, and advanced trading tools, making them suitable for beginners and those wanting regulated platforms. DEXs provide greater privacy, self-custody of funds, access to a wider range of tokens, and are integrated into DeFi, but they require more technical know-how and place security responsibility on the user. Many traders use both, depending on the situation.

-

Examples of CEXs include VALR, Binance, Coinbase, and Kraken. Examples of DEXs include Uniswap, PancakeSwap, and SushiSwap.

-

Downsides of DEXs include higher complexity for beginners, potential smart contract risks, lower liquidity for some trading pairs, no customer support, the need to pay network and protocol (gas) fees, and full responsibility for securing your own wallet and private keys.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate. VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.