Unpacking FUDamentals

Views expressed in the article below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Just two weeks after BTC’s breach of May’s all-time high (ATH), the hills are alive with the sound of FUD. A fresh China ban, announcing a further crackdown on mining in the country (after it had already been banned in May), coupled with the recent rejection of a highly ambitious spot BTC ETF application, has seen a significant drawdown for the market as a whole. At the time of writing, total crypto valuation has fallen by $300B from Sunday’s $2.8T cap, with BTC and ETH both observing ~10% retraces in recent days.

The heightened sensitivity to entirely expected and largely redundant “news” cycled vigorously through mainstream outlets could be the result of excessive leverage, as well as uncertainty as Bitcoin continues to consolidate below previous ATHs. However, examining on-chain metrics, a vastly different picture emerges presenting a solid bull case from a fundamentals perspective.

Exchange reserves

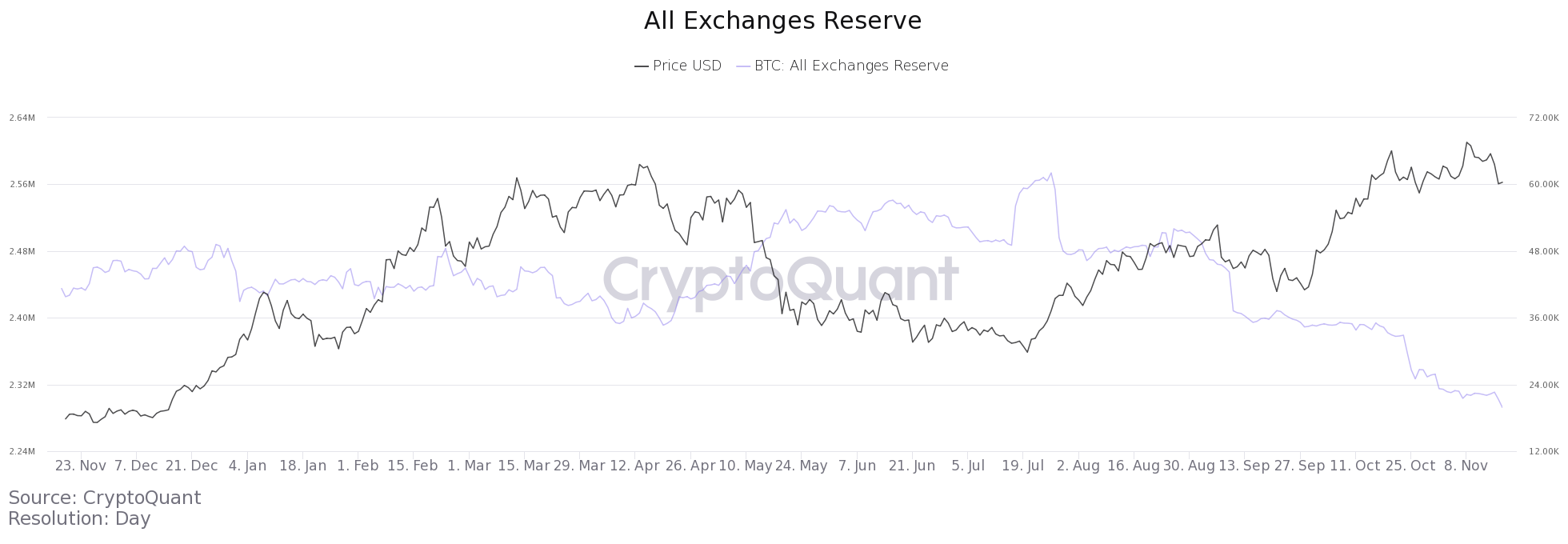

BTC exchange reserves provide insight into the volume of bitcoin currently held on exchanges, generally for trading or yield generation purposes, as opposed to those being stored off exchange for whatever purpose, including for long term hodling.

At present, exchange reserves currently total <2.3m BTC, or roughly 12% of the almost 19m BTC currently in circulation. This represents the lowest volume held by exchanges in 2021, indicating that many holders are moving their BTC off exchanges despite ongoing uncertainty in the $60k region.

BTC reserves across exchanges

Diving slightly deeper, the BTC:Stablecoin exchange reserve ratio provides an estimate of perceived selling pressure – the higher the ratio, the higher the sell pressure. Despite steadily climbing since July lows, the ratio still remains well below levels seen in the first half of the year.

BTC:Stablecoin reserve ratio

It’s worth noting, however, that while estimated leverage ratio has dipped following the recent drawdowns, it remains at its highest levels this year, indicating that the market is still flush with leverage, which could see further liquidation events in the near future before stablising.

Who’s selling?

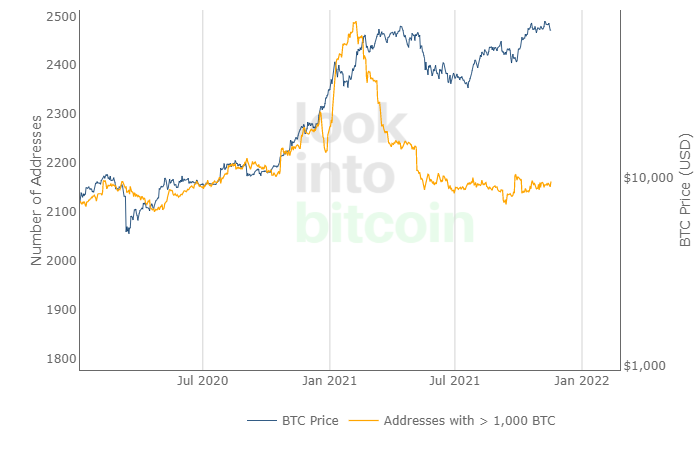

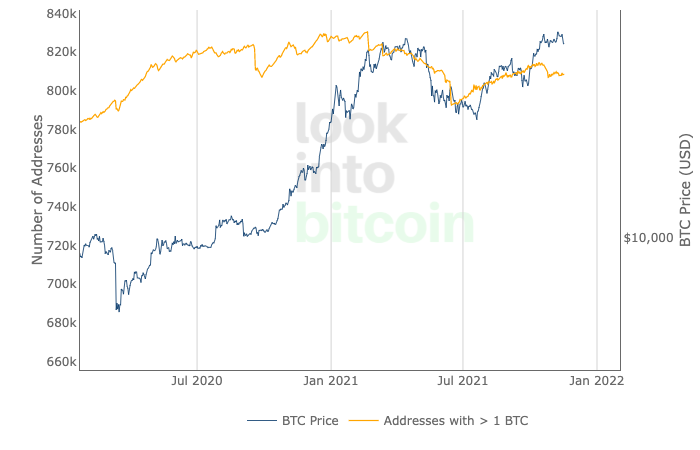

From the relatively muted liquidations of late, one could assume that the primary casualties of the recent drop are largely small retail investors with an overzealous appetite for leverage at high price points, or “late longers” as they are also known.

A look at BTC holders by wallet size seems to affirm this perspective. Bitcoin wallets holding >1k BTC have observed a steady uptick since September, even in the face of increased volatility. Conversely, wallets holding 1-10 BTC have declined since late October, moving in tandem with BTC’s price action and rapid retraces.

Forward focus

With November entering its third week, BTC remains almost 100% away from PlanB’s projected floor predictions of $98k for the month’s close. Despite waves of FUD and heightened anxiety, however, BTC’s on-chain fundamentals remain increasingly healthy. Whether we see the fabled $100k before the end of the year is still up for debate. That being said, far stranger things have happened.

As the whirlwind of this particular rollercoaster continues to increase in velocity, it’s important to hold on tight – to your targets, strategies, and exit levels. It’s been a bountiful year for many, but as has been evidenced by aforementioned late longers, overexposure in a market defined by its volatility can prove an incredibly costly endeavour.

All aboard?