USDC vs. USDT: How Do the Two Leading Stablecoins Compare?

USDC and USDT are the two leading stablecoins by market capitalization, offering much-needed price stability for crypto investors.

But how do the two stablecoins compare based on market capitalization, volume, reserves allocation, and other factors? Let's find out in this article where we explore USDC vs. USDT.

What Are Stablecoins?

To better understand the topic, let's first discuss what a stablecoin is. A stablecoin is a cryptocurrency whose value is pegged to a single or a basket of financial instruments. This underlying asset is a major fiat currency like USD or EUR. Some stablecoins are also tied to commodities like gold or silver.

Stablecoins play a critical role in the crypto space, allowing holders to minimise the risks of cryptocurrency volatility. Assets like USDC and USDT enable investors to shift from their digital asset positions without converting to fiat currency.

Stablecoins maintain a stable value while offering the benefits of blockchain technology: They are easy to transfer, have low fees, offer fast transaction speeds, and are secured by public-key cryptography. All while providing transparency via a distributed ledger.

Different types of stablecoins exist based on their underlying collateral, such as; Fiat-backed, commodity-backed, crypto-backed, and algorithmic stablecoins. USDC and USDT are fiat-backed, meaning they use physical assets to maintain their peg with the underlying currency.

What Is USDC?

USDC, Issued by Circle starting in September 2018, is a digital dollar backed 100% by highly liquid cash and cash-equivalent assets. USDC is always redeemable 1:1 for USD, offering a secure and stable way to store value in a digital currency format.

As a next-generation payment technology, USDC can be sent across borders in seconds at minimal costs, without requiring a traditional bank account. This makes it a frictionless way to exchange value globally, with near-instant, 24/7 availability for sending, spending, or saving.

Beyond international transfers, USDC can be used for storing value, accessing new financial opportunities, entering the cryptocurrency market easily, and interacting with decentralised finance (DeFi) protocols.

USDC is available natively on 29 different blockchains, including Ethereum, Solana, Avalanche, Arbitrum, Polygon, Base, Hedera, NEAR, XRP Ledger, World Chain, and others, making it highly accessible and open to everyone.

What Is Tether USD (USDT)?

Originally launched as Realcoin in October 2014, Tether USD (USDT) is another fiat-backed stablecoin that maintains price stability with the USD through physical reserves.

USDT is issued and managed by Tether Limited, a company based in the British Virgin Islands - the same company that owns the Bitfinex cryptocurrency exchange. As a stablecoin, USDT serves multiple use cases such as hedging against market volatility, enabling cross-border transfers, facilitating merchant payments, and supporting digital asset trading.

USDC vs. USDT: The Comparison of the Two Leading Stablecoins

Let's take a closer look at USDC and USDT by comparing them across several key factors:

Market capitalisation and volume

Price stability

Regulation

Transparency and reserves allocation

Supported blockchains

Market Capitalisation and Volume

As of June 16, 2025, USDT is the leading stablecoin and the third-largest cryptocurrency by market capitalization, with a value of $155.48 billion. It also ranks first in daily trading volume among all digital assets, reaching $65.61 billion in the past 24 hours.

In comparison, USDC is the second-largest stablecoin and the seventh-largest cryptocurrency, with a market capitalisation of $61.59 billion. As the main competitor to USDT, USDC has a 24-hour trading volume at $8.69 billion.

Price Stability

Both USDC and USDT have maintained a stable value since their launch, closely tracking the USD price (typically around $1).

However, there have been instances where their values temporarily deviated from the dollar, such as during major market events like the collapse of Silicon Valley Bank (SVB) and following specific company announcements like Tether's wallet-freezing policy in December 2023.

Regulation

In terms of regulation, Circle, the issuer of USDC, has been recently granted an e-money license in the European Union, MiCA. In the United States, USDC is regulated as a form of stored value or prepaid access under the laws governing money transmission (or the statutory equivalent) in various US states and territories.

In contrast, USDT is not regulated in any jurisdictions. While holders can still use it to send, receive, store, and pay with the stablecoin, recent regulatory changes may pose challenges for users in jurisdictions like the EU.

For instance, the EU's comprehensive Markets in Crypto Assets (MiCA) legislation requires stablecoin issuers like Tether and Circle to be licenced and comply with rules such as holding 60% of stablecoin reserves with European banks. Some of the MiCA's provisions came into force at the end of June 2024, while the other rules started applying to issuers in December 2024, leading to exchange delistings for USDT in the EEA.

In terms of stablecoin regulation, there's been significant progress in the United States this year. While Senators Lummis and Gillibrand introduced a new bill in April 2024, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, introduced by Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis on February 4, 2025, got very close to passage in the US Senate on June 11, when the upper chamber voted 68-30 to move forward on a substitute amendment.

Addressing an over $150 billion market, US stablecoin regulation could come with stricter rules for issuers while promoting consumer protection, innovation, and broader access to USDC, USDT, and other stablecoins for regulated financial providers.

Transparency and Reserve Allocation

Assessing the reserves of USDC and USDT is crucial for understanding their stability.

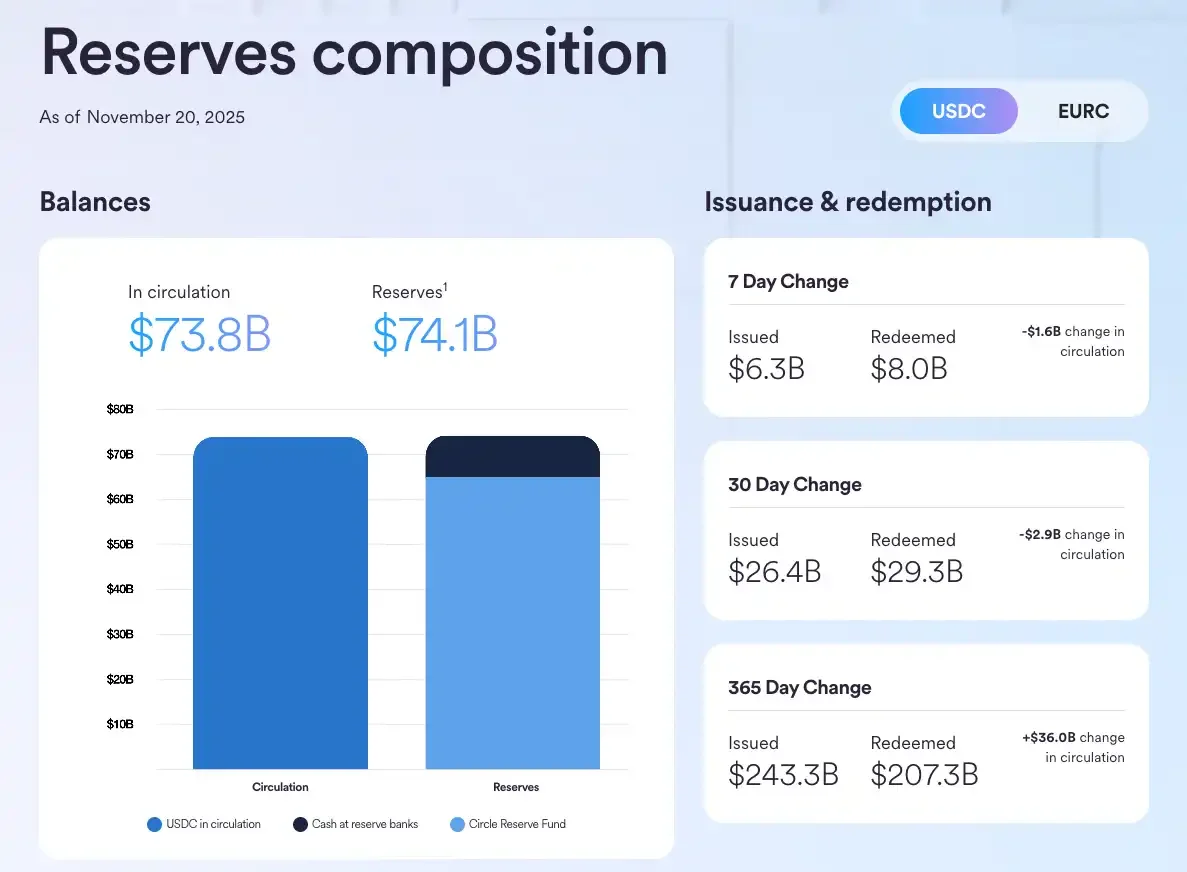

USDC's reserves are audited monthly by an independent Big Four accounting firm, with Circle providing weekly disclosures to ensure that the value of reserves exceeds the amount in circulation. All audits are conducted according to the standards of the American Institute of Certified Public Accountants (AICPA).

Source: Circle

As of Deloitte's September 2025 attestation report, USDC had 73.749 billion coins in circulation, backed by $73.814 billion in reserves, including:

$21.761 billion (29%) held in US Treasuries

$41.619 billion (56.4%) in US Treasury Repurchase Agreements

$1.004 billion (1.4%) in cash held in the Circle Reserve Fund

$9.555 billion (12.9%) cash held at regulated financial institutions

There's also $124.5 million of cash due to/(owed by) Circle and the Circle Reserve Fund due to timing and settlement differences (net), which is subtracted from the issuer's total USDC reserves

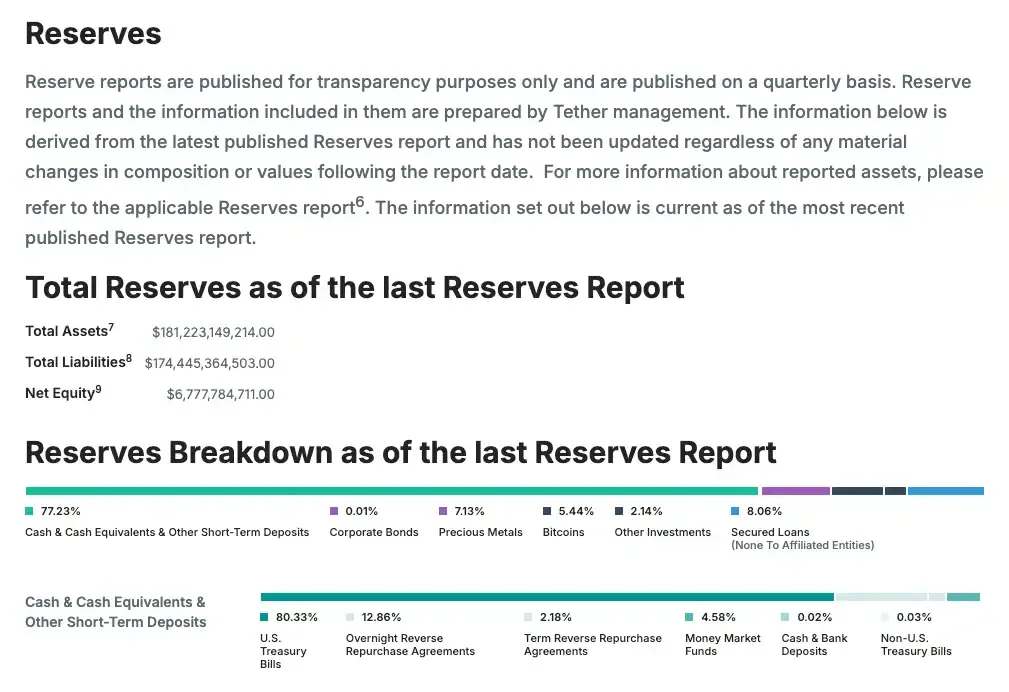

Tether, on the other hand, publishes daily information on USDT in circulation and commits to having assets exceed liabilities. Their reserves are audited quarterly by BDO Italia.

According to their September 2025 report, Tether and its subsidiaries held $181.223 billion worth of assets in their reserves, with $174.445 billion of liabilities and $6.778 billion equity. Here is a breakdown of the issuer's holdings:

$139.952 billion (77.23%) held in cash, cash equivalent, and other short-term deposits, including US Treasury bills, overnight reverse repurchase agreements, term reverse repurchase agreements, money market funds, cash and bank deposits, non-US treasury bills

$0.015 billion (0.01%) in corporate bonds

$12.921 billion (7.1%) in precious metals

$9.856 billion (5.44%) in Bitcoin (BTC)

$3.874 billion (2.14%) in other investments

$14.604 billion (8.06%) in secured loans

Source: Tether

While USDC and USDT both provide regular updates on their reserves, USDC offers more frequent reporting and holds 100% of its reserves in cash or cash equivalents. Tether maintains about 77.23% of its reserves in similar categories, with the rest in other investments.

The differences in reserve allocation do not necessarily make one stablecoin better than the other; they simply highlight different approaches to risk management that investors should consider.

Supported Blockchains

USDC is natively supported on 29 different blockchains, including Algorand, Aptos, Arbitrum, Avalanche, Base, Celo, Ethereum, Hedera, Linea, NEAR, Noble, OP Mainnet, Polkadot, Polygon PoS, Solana, Sonic, Stellar, Sui, Unichain, World Chain, XRPL, and ZKsync, with additional support via third-party bridges for other chains with Circle's Bridged USDC Standard.

In comparison, USDT is available on most blockchains, including Ethereum, BNB Chain, Solana, Algorand, Gnosis Chain, Fantom, Polygon, Klaytn, Avalanche, Optimism, Tron, Arbitrum, Tezos, and many others, making it widely accessible.

Key Differences at a Glance

| Factor | USDC | USDT |

|---|---|---|

| Market Capitalization and Volume (as of June 16, 2025) |

- 7th largest cryptocurrency - Market cap: $61.59B - 24h volume: $8.69B |

- 3rd largest cryptocurrency - Market cap: $155.48B - 24h volume: $65.61B |

| Price Stability | Stable around $1, with occasional minor deviations | |

| Regulation |

- Regulated in various US states - EU e-money license (MiCA) |

Not regulated in any jurisdiction |

| Transparency and Reserves (as of Sep 2025) |

- Monthly audits by Big Four firm - Weekly disclosures - 100% cash/equivalents |

- Quarterly audits by BDO Italia - Daily circulation info - ~77.2% cash/equivalents |

| Supported Blockchains | 29 blockchains natively | Most major blockchains |

Buy USDC on VALR

USDC is a top stablecoin with a strong reputation, offering price stability with the USD through physical reserves. Available across multiple blockchain networks, USDC can be used for a variety of purposes, including hedging against volatility, trading, and making cross-border transfers.

With VALR, accessing USDC is simple and convenient. Whether you’re looking to buy, sell, transfer, deposit, or store these assets, VALR provides a seamless platform to meet all your needs.

Frequently Asked Questions (FAQ)

-

Yes, you can exchange USDT for USDC on a cryptocurrency exchange like VALR by selecting the USDT/USDC trading pair from the "Pro Trading" menu.

-

USDC is a digital dollar that provides stability and security, backed 100% by liquid assets. It is easy to use, globally accessible, and offers transparency through regular audits of its reserves.

-

Both USDC and USDT are both leading stablecoins with unique benefits. USDC excels in transparency and regulation, while USDT offers higher liquidity and market reach. Your choice should align with your specific needs and goals.

-

USDC is pegged to the dollar, so under normal conditions, 1 USDC equals 1 USD. However, there are times, such as after major market events, when the stablecoin's value may deviate from the dollar's for very brief periods.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate.

VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.