What Are Crypto Prediction Markets? A Guide to Decentralised Forecasting

In the digital asset industry, opinions are no longer just conversation starters; they are becoming tradeable assets. Crypto prediction markets allow people to "put their money where their mouth is" regarding future events. Instead of simply guessing who will win an election or if Bitcoin will hit $100,000, users can trade shares in these outcomes, creating a financial stake in their foresight.

Prediction markets are platforms that crowdsource information to forecast the future. By aggregating the beliefs of thousands of participants who have skin in the game, these markets often produce data that is more accurate than traditional surveys. For instance, platforms like Polymarket correctly predicted the winner of the 2024 US presidential election with high accuracy before major news outlets called the race.

In this article, you'll learn what prediction markets are, how they differ from traditional betting, and which platforms are leading the charge in 2026.

What Is a Crypto Prediction Market?

A crypto prediction market is a decentralised platform that allows users to buy and sell "shares" in the outcome of a specific event. These shares typically represent a binary "Yes" or "No" outcome, priced between $0.00 and $1.00. The price of a share represents the market's collective probability of that event occurring.

For example, imagine a market for the question: "Will Bitcoin hit $100,000 by December 31?" If a "Yes" share costs $0.60, it implies the market believes there is a 60% probability of this happening. If the event occurs, the "Yes" share pays out $1.00, and the "No" share becomes worthless ($0). If BTC fails to hit the target, the "Yes" share goes to $0, and the "No" share pays out $1.00.

Prices fluctuate constantly based on supply and demand. As new information becomes available—such as a regulatory announcement or a shift in economic data—traders buy and sell shares, causing the probability to adjust in real-time. While markets exist for sports, crypto prices, and pop culture, political elections have been the primary driver of volume. A blockchain prediction market essentially turns collective sentiment into a liquid, tradeable market.

How Crypto Prediction Markets Differ From Traditional Ones

While they may look similar to sports betting on the surface, crypto and DeFi prediction markets operate on fundamentally different principles than traditional bookmakers or "the house."

The most significant difference is the peer-to-peer structure. In a crypto prediction market, you are trading against other users, not a centralised bookie. This means the odds are dynamic rather than fixed.

In traditional betting, you lock in your odds when you place a bet. In a prediction market, you hold an asset that fluctuates in value. This allows for active trading; if you bought a "Yes" share at $0.40 and the probability rises to $0.80, you can sell your position for a profit before the event even concludes.

Decentralisation is another key differentiator. By removing intermediaries, these platforms often offer lower fees and global access, although some platforms restrict users in certain jurisdictions like the US. Finally, resolution is handled transparently. Instead of a company deciding who won, these markets use decentralised oracles (like UMA) to verify real-world results on-chain, ensuring fair and automated payouts.

Best Crypto Prediction Markets: Introducing 5 Top Platforms in 2026

The landscape of the best crypto prediction markets has evolved rapidly, ranging from fully decentralised protocols to regulated entities. Here are five of the top platforms shaping the space in 2026.

1. Polymarket

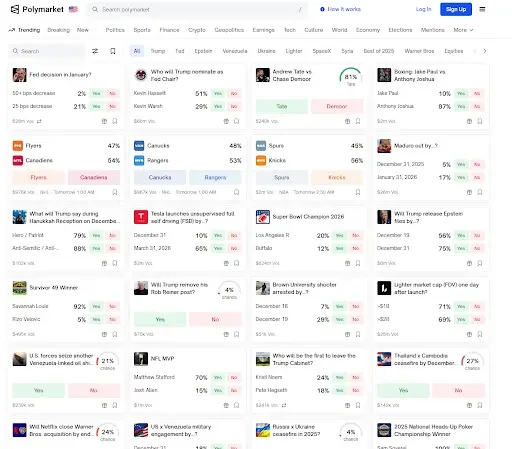

Polymarket is currently the largest decentralised prediction market in the ecosystem. Built on the Polygon network, a Layer 2 scaling solution, it utilises the USDC stablecoin for trading to ensure price stability.

The platform has seen massive adoption, reaching over $18.4 billion in trading volume. It is non-custodial, meaning users retain control of their funds, and it uses the UMA optimistic oracle to resolve disputes and verify outcomes transparently.

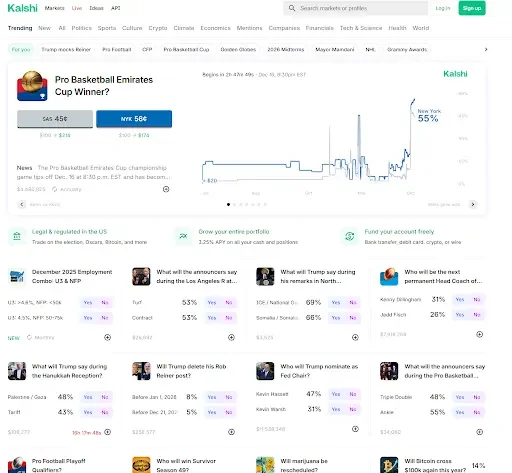

2. Kalshi

Kalshi stands out as a regulated alternative in the prediction space. It operates as a Designated Contract Market regulated by the US Commodity Futures Trading Commission (CFTC). While trades are settled in USD rather than crypto, it is a key competitor that allows institutions and US residents to trade legally on political events and economic data. In 2024, Kalshi won a significant legal victory against the CFTC, paving the way for it to list election contracts legally.

3. Gnosis

Gnosis is a pioneer in the sector, having launched in 2015. While it started as a standalone prediction market, Gnosis has evolved into a major infrastructure provider for the Ethereum ecosystem, known for the Gnosis Chain and CoW Protocol. However, its Conditional Tokens framework and the Omen platform remain vital tools, allowing developers to build decentralised prediction markets on top of Gnosis infrastructure.

4. Zeitgeist

Zeitgeist is a decentralised prediction market built specifically for the Polkadot and Kusama ecosystem. It distinguishes itself with a unique governance model known as Futarchy, where prediction markets are used to make decisions for the protocol itself. The platform is powered by the ZTG token, which is used for governance and market creation.

5. Azuro

Azuro takes a different approach by acting as an infrastructure and liquidity layer rather than a consumer-facing betting site. It allows developers to build their own prediction apps or front-ends in minutes without worrying about the backend complexity. Azuro uses a unique Liquidity Tree model to pool liquidity, making it more capital-efficient than traditional models.

+1. Augur

Augur was the first major decentralised prediction market, launched on Ethereum in 2018. While the project is largely considered a legacy platform today—with its DAO having dissolved—it laid the technological groundwork for modern DeFi prediction markets. It utilised the REP token for a decentralised reporting system where users staked tokens to verify outcomes.

Benefits, Risks, and Use Cases of a Blockchain Prediction Market

Participation in a blockchain prediction market offers unique advantages but also comes with specific risks.

Benefits

The primary benefit of blockchain prediction markets is crowdsourced wisdom. By aggregating diverse opinions backed by capital, these markets create probabilities that often react faster and more accurately than traditional polling.

They also offer a mechanism for hedging; for example, a crypto investor worried about a market crash could buy "Yes" shares on a price drop prediction to offset losses in their portfolio. Additionally, blockchain ensures transparency, as all trades and payouts are visible on-chain.

Risks

Liquidity is a major challenge. In niche markets with few participants, low liquidity can lead to slippage or price manipulation. There is also an oracle failure risk, where the data source reporting the result is disputed or corrupted, delaying payouts. Furthermore, regulation remains a complex issue, with different jurisdictions applying varying rules to these platforms.

Use Cases

Beyond simple speculation, crypto prediction markets serve critical functional roles for various participants.

Hedging real-world risk: Investors and businesses use these markets to hedge against adverse outcomes. For example, if a trader holds a significant portfolio of assets that would drop in value if "Candidate A" wins an election, they might buy "Yes" shares for Candidate A. If the candidate wins, the profit from the prediction market helps offset the losses in their main portfolio.

Real-time forecasting: Researchers and organisations utilise these platforms as dynamic sentiment barometers. Because participants are financially incentivised to be correct, the resulting probabilities often provide a more accurate and immediate reflection of public sentiment than traditional polls or surveys.

Governance: Innovative protocols, such as Zeitgeist, are exploring Futarchy—a governance model where decisions are made based on market predictions. Instead of simply voting on a proposal, a DAO might ask the market, "Will the token price rise if we approve this upgrade?" and act based on the outcome with the highest predicted value.

The Outlook of Crypto Prediction Markets

Crypto prediction markets are transforming opinions into a legitimate asset class, providing the world with a real-time sentiment barometer that is impossible to ignore. As artificial intelligence and DeFi continue to integrate, these markets are expected to grow in both accuracy and adoption, with the sector projected to potentially reach $95.5 billion by 2035.

Ready to explore the crypto market? Create an account on VALR to get started.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate. VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.