What is a Fork in Crypto? Hard Forks vs. Soft Forks Explained

Blockchains are immutable ledgers, but the software that powers them is far from static. Like the operating system on your smartphone or the apps on your computer, blockchain networks require regular updates to fix bugs, improve performance, and add new features. However, upgrading a decentralised network with no central authority is complex, often leading to an event known as a fork.

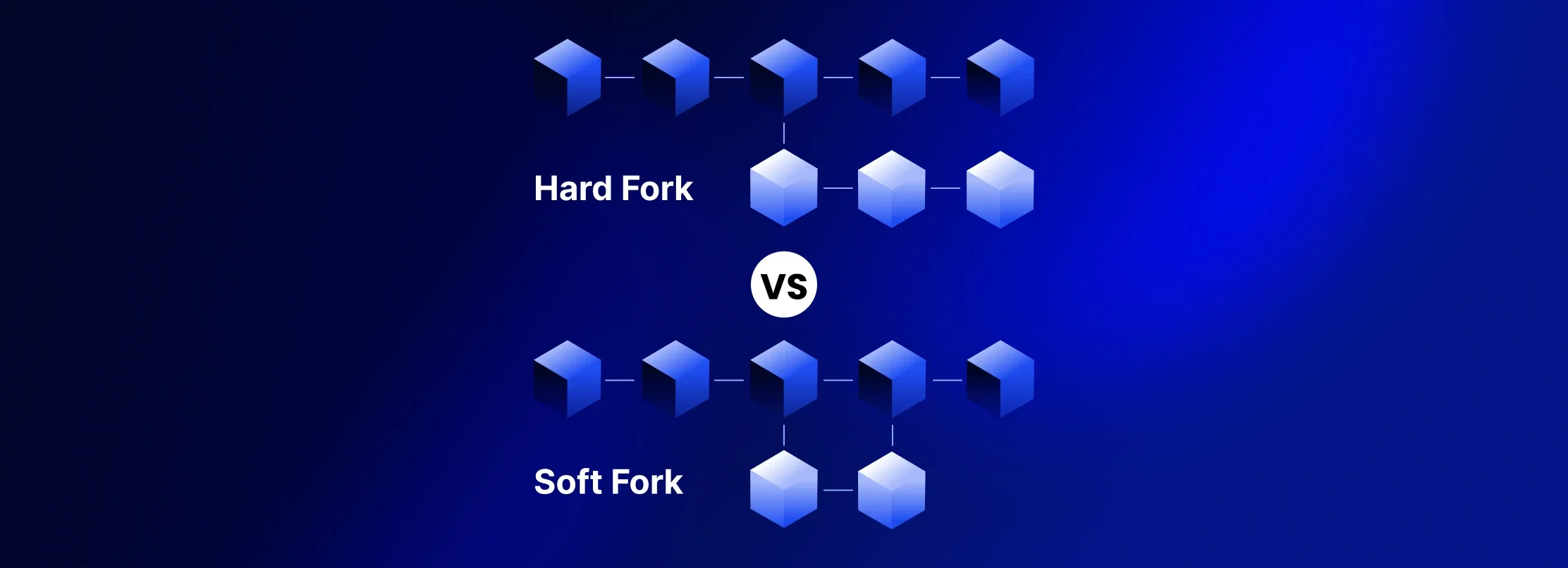

To understand how these networks evolve, it is essential to grasp the difference between the two main types of upgrades. A hard fork creates a permanent split in the network, often resulting in a new cryptocurrency, while a soft fork is a backward-compatible upgrade that updates the protocol without splitting the chain. Whether driven by technical innovation or community disagreement, these forks are essential mechanisms for maintaining the health and security of the crypto ecosystem.

In this article, we'll explore the mechanics of blockchain forks, the key differences between a hard fork and a soft fork, and what these changes mean for your crypto portfolio. Let's get started!

What Is a Fork in Blockchain Networks?

In the context of cryptocurrency, a fork is essentially a change in the digital rules or protocol of a blockchain network. Because blockchains are decentralised, there is no central server to push an update to everyone simultaneously.

Instead, the thousands of nodes that run the network must agree on the rules. When developers propose a change to the software, or when the community disagrees on the transaction history, the blockchain diverges—like a fork in a road—creating two potential paths forward.

What is a Soft Fork?

A soft fork is a gentler, backward-compatible upgrade. In this scenario, the new rules are compatible with the old rules. Nodes that have not been upgraded can still process transactions and push new blocks to the blockchain, although they may not be able to use the specific new features introduced by the update. Soft forks typically involve tightening the rules of the protocol rather than rewriting them entirely.

A famous example is Bitcoin's Segregated Witness (SegWit) update in 2017. This upgrade changed how transaction data was stored to allow for greater throughput. It was implemented as a soft fork, meaning nodes that did not upgrade could still operate on the network without causing a chain split.

What is a Hard Fork?

A hard fork is a radical upgrade to the network's protocol that makes previously valid blocks or transactions invalid (or vice-versa). Crucially, a hard fork is non-backward compatible. This means that nodes running the old version of the software will not accept the new version's blocks.

To participate in the new chain, all nodes and miners must upgrade their software. If a significant number of participants refuse to upgrade and continue running the old software, the blockchain splits permanently into two separate networks, often creating a new cryptocurrency in the process.

Notable examples include the 2017 Bitcoin Cash (BCH) hard fork, which occurred due to a disagreement over increasing the block size, and the 2016 Ethereum Classic (ETC) fork, which happened after the community voted to reverse the effects of the infamous DAO hack.

Why Do Forks Occur in Blockchains?

Forks are not random accidents; they are usually deliberate actions driven by specific needs within a blockchain ecosystem. Potential reasons why forks could take place include:

Technical Innovation and Scalability: As blockchains mature, developers often need to implement features to make the network faster or more efficient. For example, increasing the block size to handle more transactions per second is a common technical driver for forks.

Security Risks: Sometimes, forks are necessary to fix critical security vulnerabilities. If a major bug is discovered that could allow for double-spending or inflation, developers may issue a fork to patch the hole. In extreme cases, such as the Ethereum DAO hack, a hard fork may be used to reverse malicious transactions and return stolen funds to users.

Community Disagreements: Because blockchains are community-run, disagreements are inevitable. When a community cannot agree on the future direction of the project—such as the debate between large blocks versus small blocks—a contentious hard fork allows both sides to part ways. This enables the dissenting group to create a new chain that reflects their specific values and vision.

Hard Fork vs. Soft Fork: What's the Difference?

While both mechanisms are used to update blockchain software, they differ fundamentally in how they handle compatibility and the unity of the network. A hard fork forces a choice and can split the chain, whereas a soft fork aims to keep the network together through compatibility.

The table below outlines the key differences between a hard fork and a soft fork:

| Feature | Hard Fork | Soft Fork |

|---|---|---|

| Backward Compatibility | No. Old software is incompatible with the new chain. | Yes. Old software can still operate on the network. |

| Blockchain Split | Yes. It creates a permanent split if not everyone upgrades. | No. It maintains a single blockchain history. |

| New Coin Creation | Likely. If the community splits, a new coin is born (e.g., BCH). | No. The asset remains the same. |

| Node Upgrade Requirement | Mandatory. Nodes must upgrade to follow the new chain. | Voluntary. Only miners/validators strictly need to upgrade. |

| Risk of Chain Split | High | Low |

| Example | Bitcoin (BTC) vs. Bitcoin Cash (BCH) | Bitcoin SegWit Upgrade |

What Forks Mean for Users?

For the average crypto investor, the impact of a fork depends largely on the type of update occurring.

Impact on Assets

In the case of a soft fork, users generally do not need to do anything; the network updates smoothly in the background. However, a hard fork can have financial implications. If a hard fork results in a chain split and the creation of a new coin, holders of the original asset often receive an equal amount of the new coin.

For example, when the Bitcoin Cash hard fork took place in 2017, BTC holders received an equivalent amount of BCH. To claim these, users typically need to hold their private keys or have their funds on an exchange that supports the distribution of the new token.

Governance and Community

Forks are the ultimate expression of decentralised governance. They represent a democratic process where miners, developers, and node operators vote with their computing power. A contentious hard fork forces the community to choose a side, which can lead to temporary volatility and uncertainty as the market decides which chain has more value.

Risks

While profitable for some, forks come with risks. One technical danger is a replay attack, where a malicious actor intercepts a transaction on one chain and validly broadcasts it on the other chain, potentially moving funds without the user's permission. Fortunately, most modern hard forks implement replay protection to prevent this from happening.

The Natural Evolution of Blockchains

Forks are not signs of failure; they are features of open-source software evolution. They demonstrate the ability of a blockchain to adapt, upgrade, and resolve conflicts without a central authority. Whether it is a smooth soft fork improving transaction efficiency or a dramatic hard fork birthing a new cryptocurrency, these events represent the market's constant push toward better technology and governance.

Whether you are interested in the original chains or the new assets created by these splits, you can gain exposure to a wide range of digital assets on VALR. Create an account now to get started!

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate. VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Frequently Asked Questions (FAQ)

-

A hard fork is inherently neutral. It can be "good" because it allows for innovation and gives users the freedom to choose their preferred protocol, but it can be "bad" if it fractures a community and temporarily dilutes the network's security.

-

If you simply hold your assets, usually nothing happens to your original funds. If the hard fork results in a split, you may end up owning equal amounts of the new coin on the new chain (e.g., holding 1 BTC resulted in having 1 BTC + 1 BCH).

-

Yes, Bitcoin has undergone multiple hard forks. The most famous example is the creation of Bitcoin Cash (BCH) in 2017, but other forks include Bitcoin Gold (BTG) and Bitcoin SV (BSV).

-

Practically, no. Once the chain splits and the transaction history diverges, the change is permanent unless the community and miners decide to abandon one chain entirely, which is rare.

-

Not always, but it can if the community splits. If everyone agrees to the upgrade, no new coin is created (it is just an upgraded protocol). If there is a disagreement, a new coin is born on the new chain.

-

The main risks include price volatility, market confusion, and technical issues like replay attacks (if protection is not implemented). There is also a risk of scams where malicious sites claim to help you "claim" forked coins to steal your private keys.

-

You can usually find this information in the project's official news channels or GitHub repository. If the update requires a mandatory software update for all nodes to stay on the network, it is a hard fork.

-

For the general user and non-mining node, yes. However, for miners, a majority hash rate must eventually upgrade to enforce the new rules; otherwise, the soft fork activation might fail.