Can you feel it, anon?

Views expressed in the article below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Outwardly, crypto can often present as a chaotic family dinner. BTC maximalists evangelise from their lofty stools, ETH diehards wax lyrical about the power of Vitalik’s upcoming upgrades, and DeFi users complain about the price of gas. In amongst them, traders argue over patterns divined by The Charts, and everyone takes a turn to promote their preferred flavour of fork, oracle, or novel smart contract protocol. Kids sit under the table cross-legged, eagerly trading cute animal collectibles for thousands of dollars. Alright, this may not be your typical family.

Dysfunctional at best, but a family nonetheless, united by one common denominator – a passion for disruptive technology and its power to challenge established paradigms.

Entering price discovery

As bitcoin catapulted through its $64k all-time high (ATH), the euphoria of a shared effort finally coming to fruition has been almost palpable. Traumatic memories of June and July’s consolidation seem little more than fever dreams, with BTC having mounted a blistering rally from sub-$30k lows over the past two months. This week’s action was spurred by the successful launch of bitcoin’s first ETF on the New York Stock Exchange, as adoption continues to grow through fresh avenues. Despite not being the spot-based ETF demanded by purists, ProShares’ launch of BITO seems to have added fuel to the fire of current bullish sentiment, with BTC rushing towards PlanB’s ~$100k Stock-to-Flow target with increased urgency.

A look at liquidations

Examining Bybt’s data, Tuesday saw the liquidation of $253m in short positions, while Wednesday saw the liquidation of a similar volume of longs as BTC observed a rapid retrace from $67k highs. While significant, these numbers are dwarfed by the multi-billion dollar cascading liquidations observed during times of high volatility in previous months. This could perhaps indicate that the charge toward ATH was largely priced-in by the market, with even the staunchest of bears reluctant to risk being buried in its wake.

Bybt total liquidations, July - present

That’s not to say large-scale liquidations are a thing of the past – they remain an intrinsic component of crypto’s organised chaos, and leveraged positions are likely to see less stability as volatility ramps up as bitcoin enters price discovery, and ethereum on the brink of breaching its own $4,3k ATH.

Many may agonise over the best strategy to trade through a bull market moving at maximum velocity, only to find that the best strategy may be to not trade at all. Put another way, for a brief moment on Wednesday, anybody who had simply bought and held BTC since its inception to date was in profit.

Forward focus

Despite currently consolidating below the previous ATH, BTC looks set to maintain its rabid momentum as institutions and new waves of retail look to adopt crypto. The composition of the market has grown dramatically since we last found ourselves in peak-Bull fervour in 2017. Despite the squabbles of maximalists, the wealth of new competition invariably breeds further innovation, tackling new domains of culture, community, and finance with every passing day.

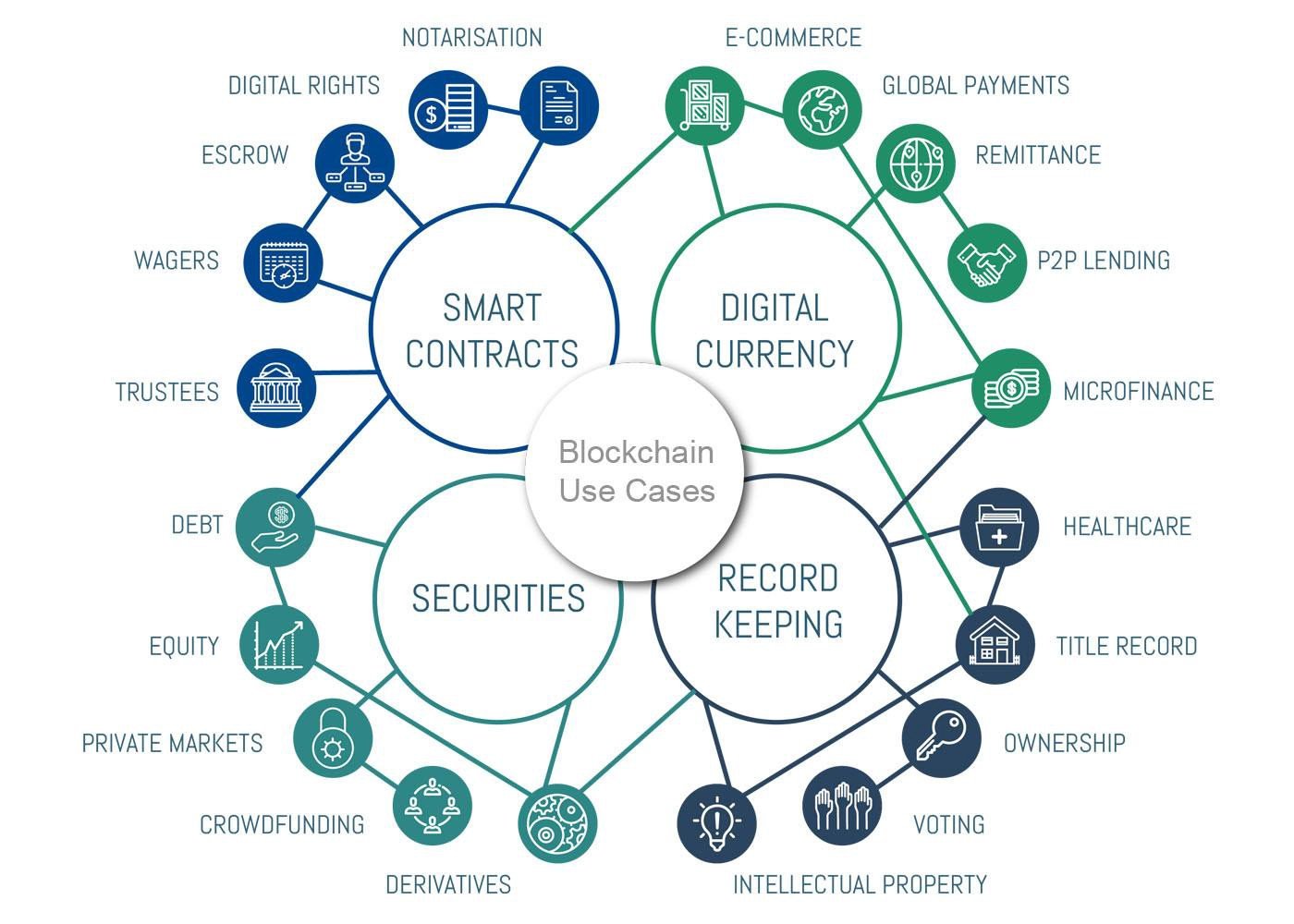

Examples of potential blockchain use cases

Taking in everything the space has accomplished in only a decade, it’s hard to fathom the magnitude of growth in the arena still to come. A legion of 200 million crypto users is significant, but nowhere near the eight billion humans that blockchain technology aims to empower. As we approach a critical-mass for adoption in coming days, months, and years, its indisputable that we’re witnessing a new technological revolution, the scale of which has barely been unearthed. How lucky we are to be a part of this journey. Still early.