4 Easy Steps to Start Trading Bitcoin in South Africa

Why would anyone trade magical internet money when we've got perfectly good rand notes adorned with Nelson Mandela's face? It's a fair question, but here's the thing: while Madiba's face is priceless, the world is moving towards a digital future that knows no borders, and getting ahead of the curve by trading cryptocurrencies opens up a realm of international opportunities.

In this guide, I'll walk you through the basics of Bitcoin trading in South Africa. As the most popular cryptocurrency, you'll learn what Bitcoin is and why it matters, how to set up your digital wallet, the different ways to trade, and why you'll soon be explaining to your friends that you're suddenly obsessed with candlestick charts.

No jargon, no hype – just straightforward steps to get you started. Let's go!

What Is Bitcoin (BTC)?

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, is the world’s first decentralised cryptocurrency.

Over the past 15 years, it has taken the financial world by storm and currently dominates over half of the digital asset market, accounting for 56.31% of the total market value as of August 2024.

Bitcoin operates as a peer-to-peer electronic cash system. This means you can send, receive, and store BTC without needing a middleman or worrying about geographical restrictions. Many see it as a store of value thanks to its limited supply and built-in deflationary mechanism (those famous Bitcoin halving events!).

Bitcoin's key features include:

Decentralisation: No central authority controls Bitcoin, making it truly peer-to-peer.

Transparency: Every transaction is recorded on Bitcoin’s public ledger for anyone to inspect.

Accessibility: Anyone with an internet connection can join the network.

Resilience: Over 15 years, Bitcoin’s uptime has been an impressive 99.99%.

How to Start Bitcoin Trading in South Africa

Now that you know what Bitcoin is, let’s get into how you can start trading it on VALR in just four easy steps.

1. Have a Trading Strategy Ready

Before you start trading BTC or other crypto assets, you should first develop a solid strategy that aligns with your goals, risk profile, and trading style.

Having a plan can significantly increase your chances of winning trades. However, you must follow it diligently and consistently to keep your emotions under control, reduce risks, and achieve optimal results.

Check out this article on VALR's blog to learn about five excellent strategies for trading crypto futures (they can come in handy for spot traders as well).

2. Log Into Your VALR Account

The next step is to log into your VALR account. If you don't have one, then use this link to register. Don't forget to verify your account, which will only take a few minutes of your time.

3. Deposit ZAR

To start trading Bitcoin, you’ll need to fund your VALR account with South African Rand (ZAR). You can deposit funds via bank transfer or credit/debit cards.

Bank Transfers: Once you’re in your ZAR wallet, select “Deposit”, choose “Via EFT” to transfer funds from your bank account and then follow the on-screen instructions.

Credit or Debit Cards: Alternatively, you can deposit ZAR using a South African-issued Visa or Mastercard. Just remember, there’s a 24-hour rolling limit of 10,000 ZAR for card deposits.

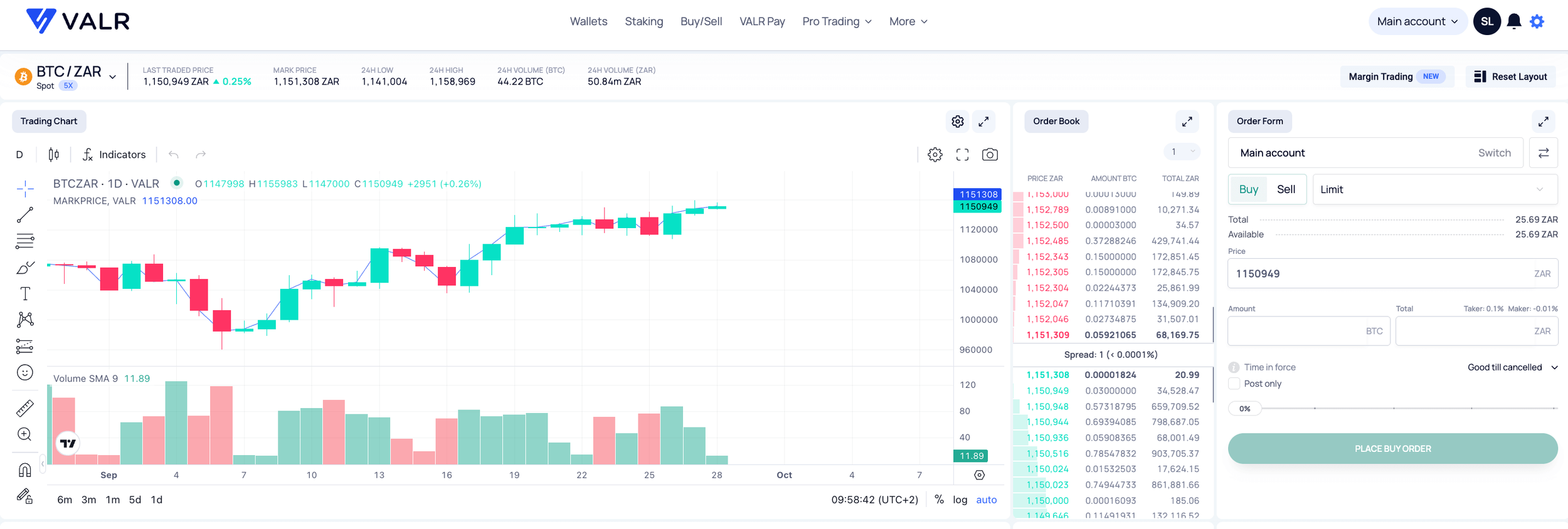

4. Trade Bitcoin on VALR

With your account funded, you’re ready to start trading Bitcoin. VALR offers a variety of trading options to suit different experience levels:

Spot Trading: Buy and sell Bitcoin without leverage directly on the spot market.

Spot Margin Trading: You can use up to 5x leverage to amplify your potential profits (and losses) via spot margin trading on VALR.

Futures Trading: You can trade Bitcoin futures with up to 10x leverage, giving you the option to go long or short on BTC.

Or, if you’re after something simpler, VALR’s Simple Buy/Sell feature allows you to quickly purchase Bitcoin using ZAR with just a few clicks.

Frequently Asked Questions (FAQ)

-

It depends on your strategy! If you think Bitcoin prices will rise, you might want to go long. If you think prices will fall, shorting Bitcoin could be a good option. VALR’s platform allows you to do both.

-

VALR offers Bitcoin trading in South Africa and beyond in both the spot and futures markets. Use this link to get started!

-

When you trade Bitcoin on the spot market, you’re using your own funds to buy and sell BTC. With futures, you can use leverage to take long or short positions without actually owning the Bitcoin. Learn more on our blog.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate.

VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Futures trading is provided by VALR DAM Pty Ltd as a Juristic Representative of CAEP Asset Managers Pty Ltd (FSP number: 33933) an authorised financial services provider.