The Beginner’s Guide to Runes Protocol

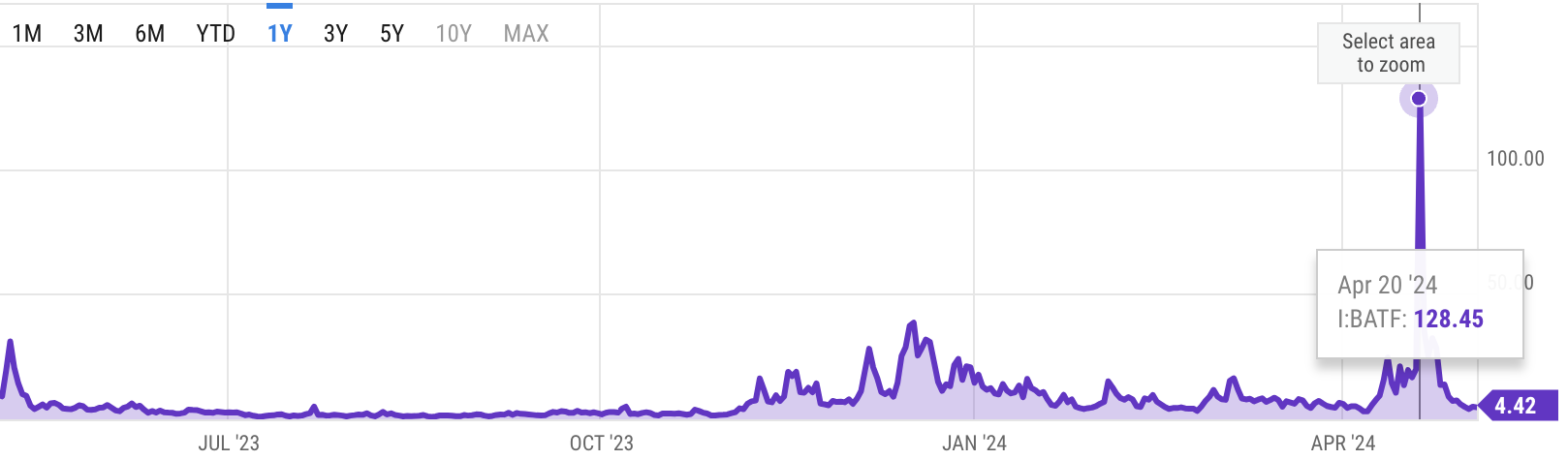

The launch of Runes Protocol, following the 4th Bitcoin halving, caused chaos in the Bitcoin network. While it introduced a simple, UTXO-based fungible token protocol for Bitcoin, Runes also increased the average BTC transaction fee to as high as $128.45 on April 20, 2024.

What is Runes on Bitcoin?

Created by Casey Rodarmor, the BTC developer behind the Ordinals Protocol, Runes introduces native fungible token issuance on top of the Bitcoin blockchain.

Debuting alongside the 2024 Bitcoin halving on block 840,000, Runes presents a compelling alternative to existing BTC-based fungible token solutions like BRC-20 and the Omni Layer, with responsible Unspent Transaction Output (UTXO) management and minimal on-chain footprint.

A UTXO refers to a specific amount of unspent coins, and it is the primary technique the Bitcoin network utilizes to track balances.

As part of a simple design based on Bitcoin's UTXO model, Runes provides an efficient way to launch fungible tokens (e.g., governance and utility tokens) on top of the BTC blockchain without bloating the mainnet with excessive junk UTXOs. Less complexity and on-chain data storage via the UTXO help issuers benefit directly from the network's resilient security and reduce the risks of vulnerabilities.

And since the maximum size of a block is limited to 4 MB max, optimising data storage and usage for transactions helps enhance the network's scalability (or at least mitigate some of the negative impacts of its limited throughput).

The Impact of Runes Launching on Bitcoin Halving 2024

Since Runes activated on the same block as 2024's Bitcoin halving, it caused Bitcoin transaction fees to rise significantly.

In fact, while the average cost for miners to process a transfer increased to nearly $130 by April 20, one user paid nearly 8 BTC ($516,000 at the current price of $64,500 per BTC) to send Bitcoin. Simultaneously, there were multiple blocks at which miners generated more revenue from transaction fees than from block subsidies. Under normal circumstances, block subsidies account for most Bitcoin miners' income.

However, the sudden popularity behind Runes is not the only reason for the exponential growth of post-halving BTC transaction fees. Besides the hype, Runes usage of the capital Latin alphabet limits the options for developers and users to create assets. If two issuers want to create a Rune-based asset with the same name, only the first will get to issue the token and keep the name.

The above process also created an opportunity for sniping. When someone wanted to issue an asset on top of Runes and their transaction was sent out to the mempool to later get processed by miners, observers could check the mempool and quickly snatch the issuer's asset name by initiating the same transaction but with a larger fee.

Since most miners prioritize transactions with higher fees, the second user's transaction is very likely to be processed the first and the original issuer's the second. Consequently, while both of them must pay transaction fees to miners, only the second user will manage to issue the asset. And to prevent such occasions, many issuers have set very high fees for their transactions on purpose.

The Future of Runes

With an efficient, on-chain, UTXO-based native asset issuance protocol, Runes enables issuers to seamlessly create new fungible tokens on top of the Bitcoin blockchain. While the launch did not go as intended, Bitcoin transaction fees have since dropped to an average of $13.42 by April 26.

And despite it’s rocky start, Runes continues to inspire developers to innovate in token creation on Bitcoin.

-

To purchase Runes, you first need to ensure you have a Bitcoin wallet and sufficient BTC. Runes are transacted on the Bitcoin network, so buying BTC is the first step. You can purchase BTC on major cryptocurrency exchanges like VALR. Once you have BTC, you can participate in marketplaces such as Magic Eden where Runes are traded.

-

Runes provide a streamlined, efficient protocol for issuing fungible tokens directly on the Bitcoin blockchain. They enable the creation of governance, utility tokens, and other digital assets while leveraging Bitcoin’s robust security model.

-

While both Runes and Ordinals were created by Casey Rodarmor and operate on the Bitcoin blockchain, they serve different purposes. Runes focus on fungible token issuance using the UTXO model, providing an efficient way to launch and manage tokens. In contrast, the Ordinals Protocol is designed for creating and managing non-fungible tokens (NFTs) on Bitcoin. Ordinals allow for unique digital assets, whereas Runes cater to interchangeable tokens with equal value.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate.

VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.